January 15th, 2019 by Dale Russell

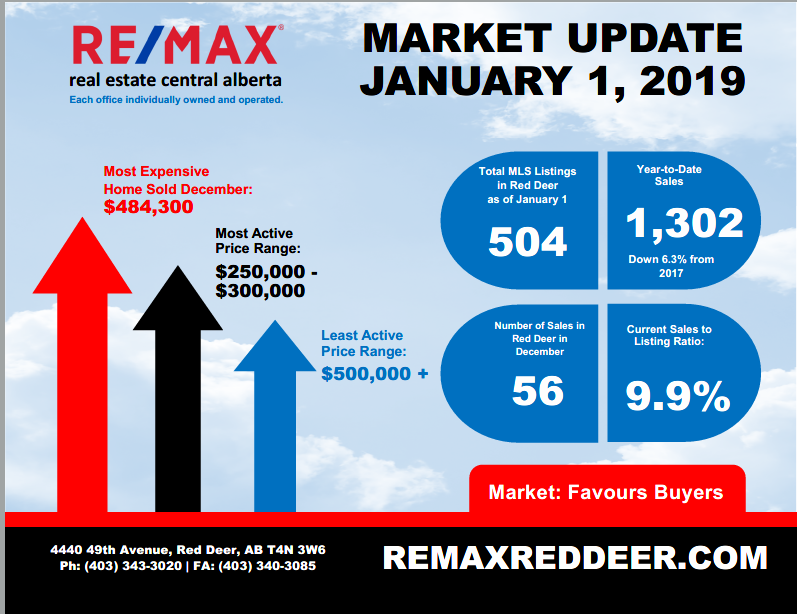

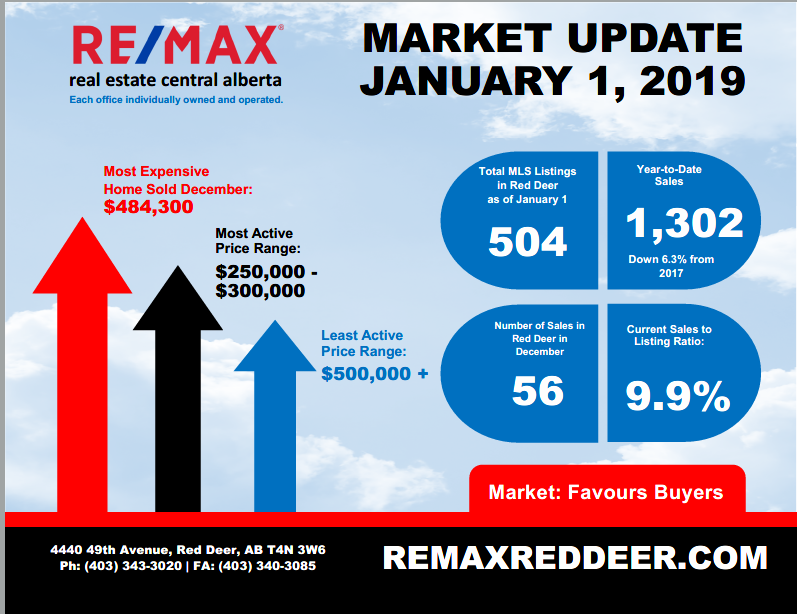

It’s human nature to want to start the new year off full of hope and optimism and we believe 2019 certainly has the potential to be better than 2018 in many ways. Alberta’s economy has been struggling since January 2015 when oil prices crashed, finally recovered, and then crashed again because of the crippling price differential we experienced this past year.

What can change in 2019? No one can argue that Alberta’s economy is energy based and any energy related improvements are good for our economy. The Line 9 pipeline to the U.S. should be completed. The Trans Mountain pipeline could be approved. And, there will be provincial and federal elections that could have an impact on a number of energy projects. Any of these events will have a positive impact on our economy and more importantly on consumer confidence which is the precursor to a better economy.

Finally, the punishing mortgage rules inflicted on all of Canada as a solution for heated housing markets in Toronto and Vancouver have piled on top of the energy crisis to create a perfect storm for our housing market. Alberta home buyers have lost tens of thousands of dollars of borrowing power as a result. The federal government could easily create regional policies that apply only to the markets that need them. A move like that would immediately have a positive impact on our housing market. Here’s hoping!

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – January 1, 2019

December 21st, 2018 by Dale Russell

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – December 15, 2018

December 21st, 2018 by Dale Russell

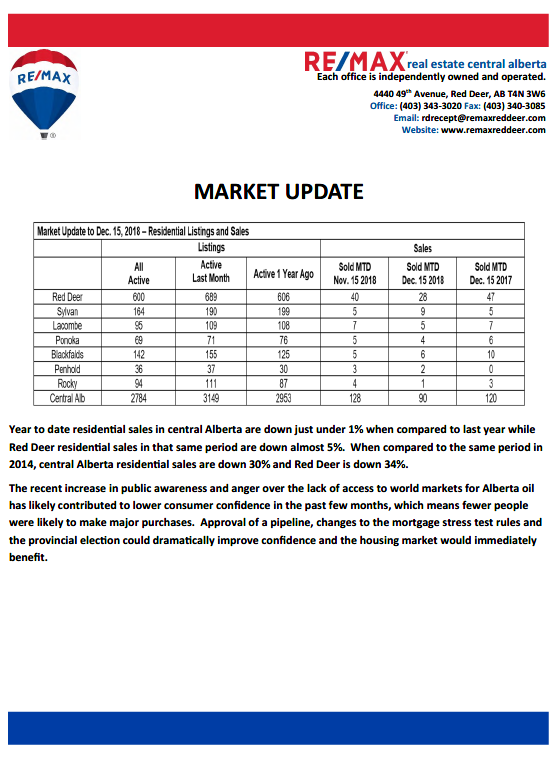

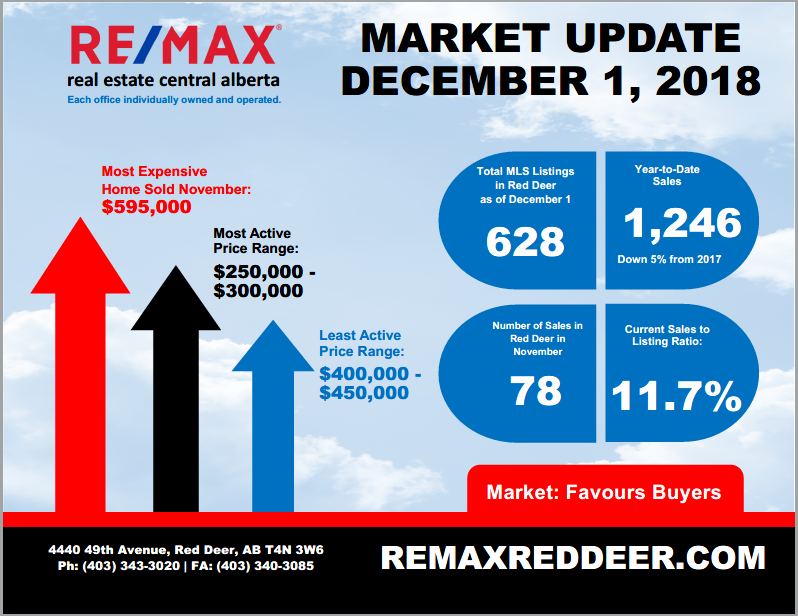

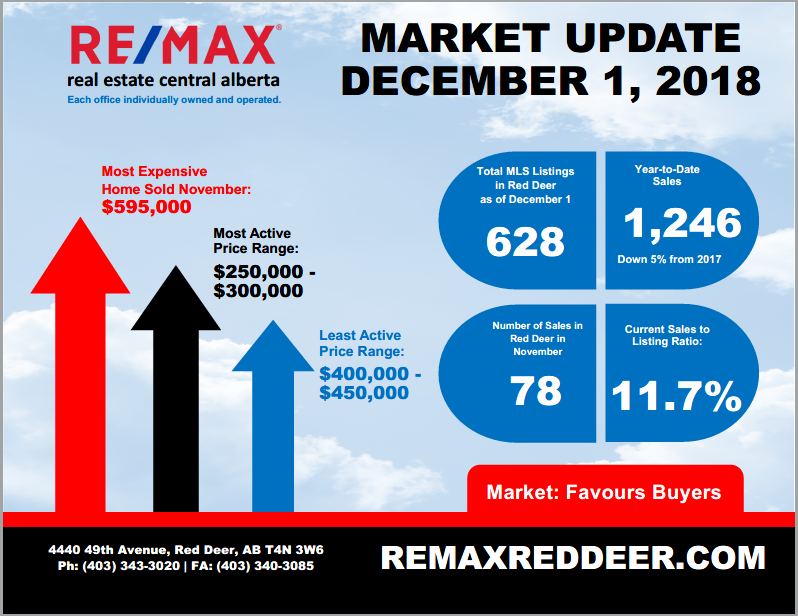

Central Alberta sales have been slipping compared to last year since the end of August when the announcement came from the Federal Court that the Trans Mountain Pipeline was stalled due to inadequate consultation by the Federal Government. Since then Alberta consumers have experienced growing concern over the price discount Alberta is receiving for our oil and the potential long term impact on our economy.

It would seem unlikely that we could take anything positive from the current situation, but we sense that Albertans, and many other Canadians, have finally had enough and are starting to loudly protest the Federal Government’s lack of urgency in dealing with our problems. When average citizens speak loudly, governments are well advised to listen, especially with an election less than a year away. There is hope for change, but we all must get even louder.

While we are optimistic for the long term future, a recovery in house prices will not happen until the sales to listing ratio rises above 20%. The problem is, it’s gone the wrong direction in the last few months. Until that changes, only those sellers able and willing to recognize the current price reality will be successful. In the meantime, there is no question that willing and able buyers will benefit.

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – December 1, 2018

November 21st, 2018 by Dale Russell

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – November 15, 2018

November 16th, 2018 by Dale Russell

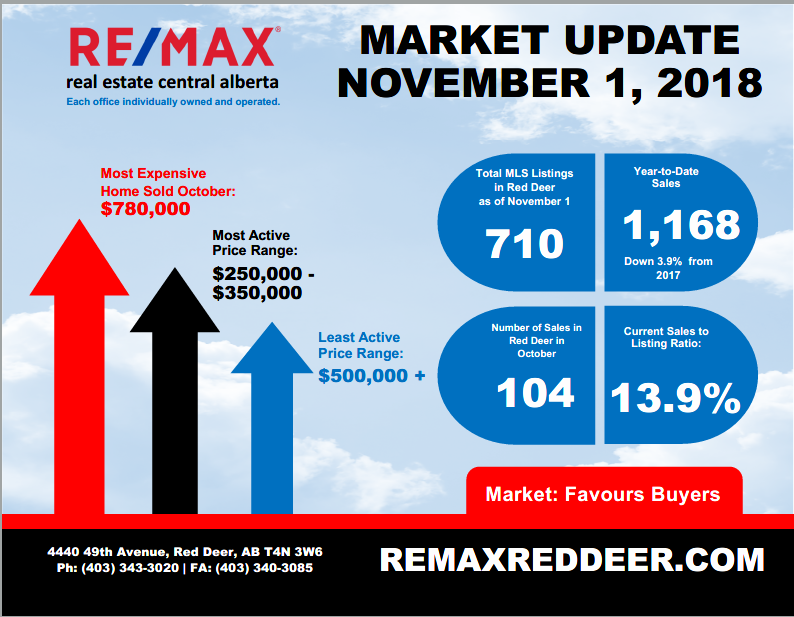

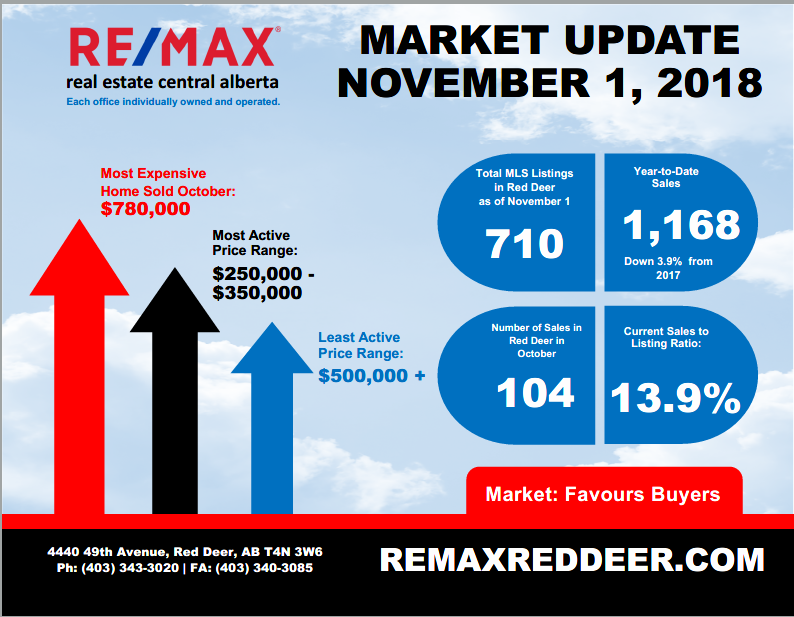

There are a number of economic indicators that suggest the Alberta economy is gradually recovering from the downturn that started in January 2015 when oil prices began to free fall. Alberta Treasury Branch economic updates over past weeks have highlighted a return to population growth, increased employment, strong vehicle sales, growing restaurant receipts and higher wages as proof that we are making gains.

In the past forty years Alberta has experienced at least five economic reverses, some more drastic than others. Many who can remember the early eighties believe this most recent one to be almost as bad. The common denominator is that we always recover to even better times, although this recovery has been slower than most simply because oil prices were depressed for longer.

The improving economy hasn’t translated to the real estate market yet, but it too will recover. The question on every seller’s mind is when? The simple economic principle of Supply and Demand provides the answer. When Supply and Demand are balanced, prices will stabilize. When Demand outpaces Supply, prices will go up. In the meantime, buyers have an unprecedented opportunity to take advantage of ample choice and very attractive prices.

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – November 1, 2018

October 19th, 2018 by Dale Russell

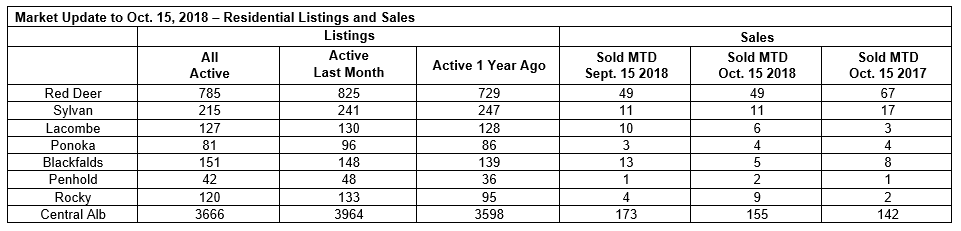

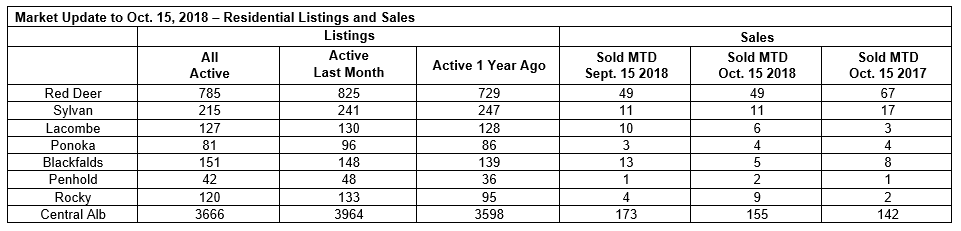

The active listing count is lower compared to last month in every market except Blackfalds. The reduction isn’t massive, but it is the path to a balanced market which is what we need to stabilize prices. The sales count in the first half of October is also lower than last month, but higher than a year ago. The market still favours buyers; but may be finally turning.

Serious buyers may want to consider the impact of an almost certain interest rate increase on October 25th (the next date that the Bank of Canada sets its rate). Most pundits are certain that rate will go up because inflation is up. The banks often raise mortgage rates before that date in anticipation of a rate increase.

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – October 15, 2018

September 14th, 2018 by Dale Russell

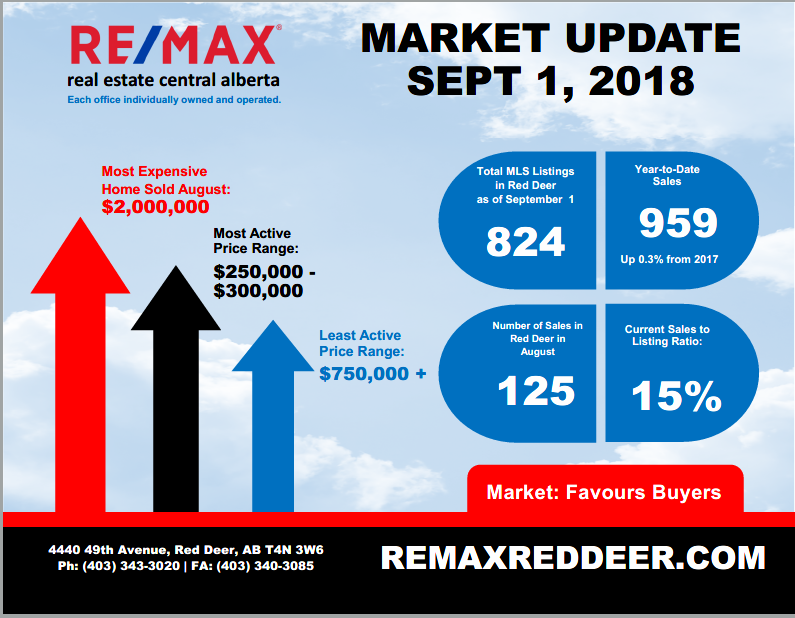

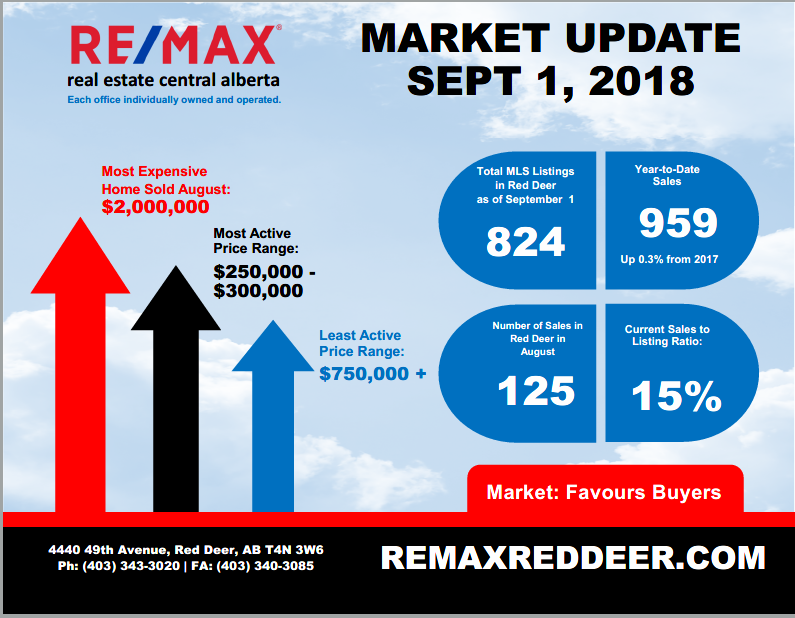

In spite of the heat and smoke, August turned out quite nicely in Red Deer, Lacombe, Sylvan Lake and Blackfalds with stronger than expected sales. At the same time the number of active listings continued their downward trend, pushing supply and demand slightly closer to balance. Ponoka, Rocky Mountain House and Penhold didn’t experience the same sales activity, but the number of active listings did come down slightly. Unfortunately, we have a long way to go to get the market back to balance and prices will remain depressed until then.

For the last three and a half years the Alberta real estate market has experienced excess inventories, slow sales and declining prices. Any gains we should have made from the economic recovery have been offset by crippling changes the federal government applied to mortgage qualifying rules.

Will the ongoing challenges to construction of the Trans Mountain Pipeline will affect the real estate market? The simple answer is yes, but it’s important to note there is still hope that the issues can be resolved. The Federal Government is heavily invested in this project both politically and financially and must find a solution.

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – September 1, 2018

August 22nd, 2018 by Dale Russell

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – August 15, 2018

August 8th, 2018 by Dale Russell

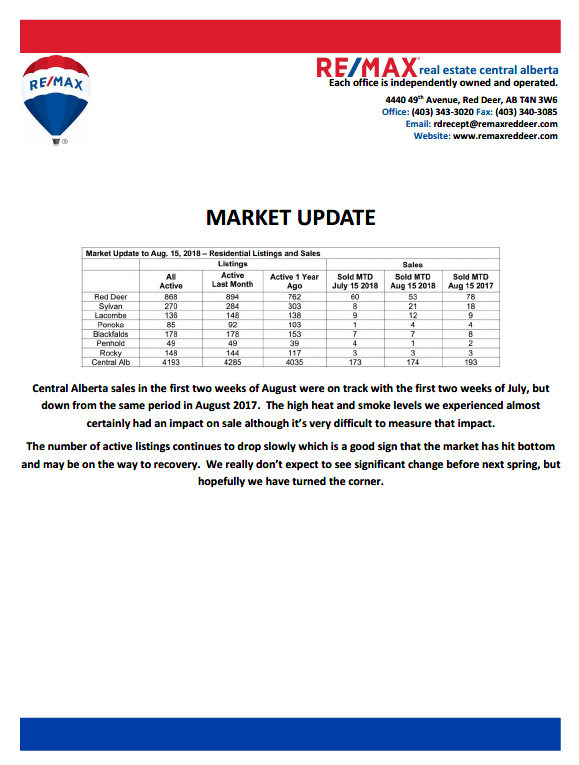

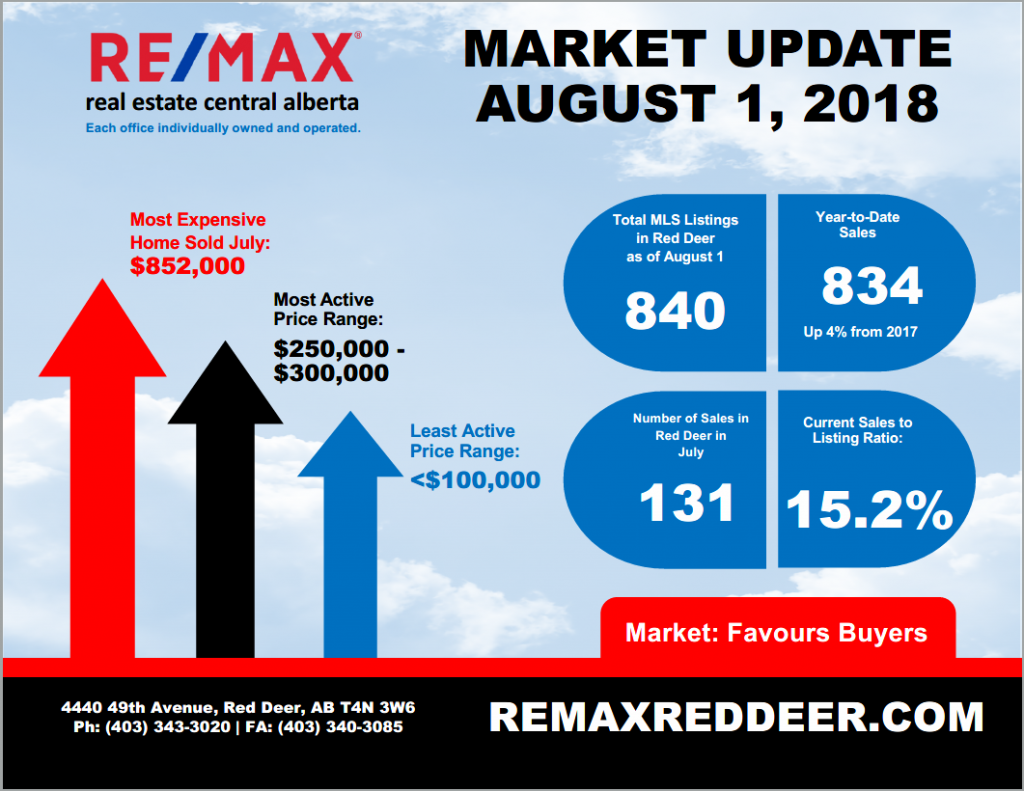

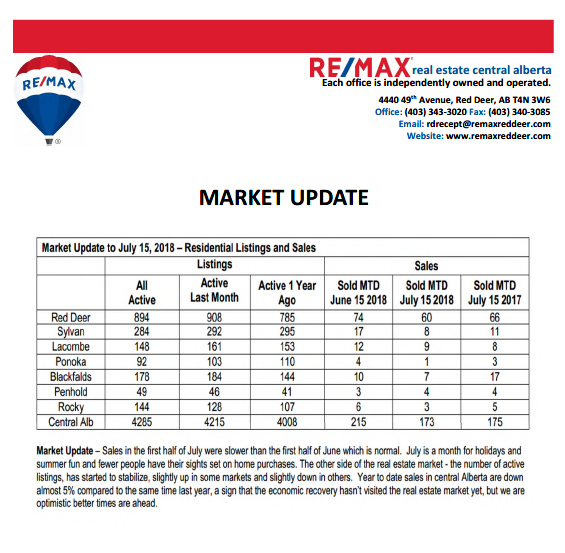

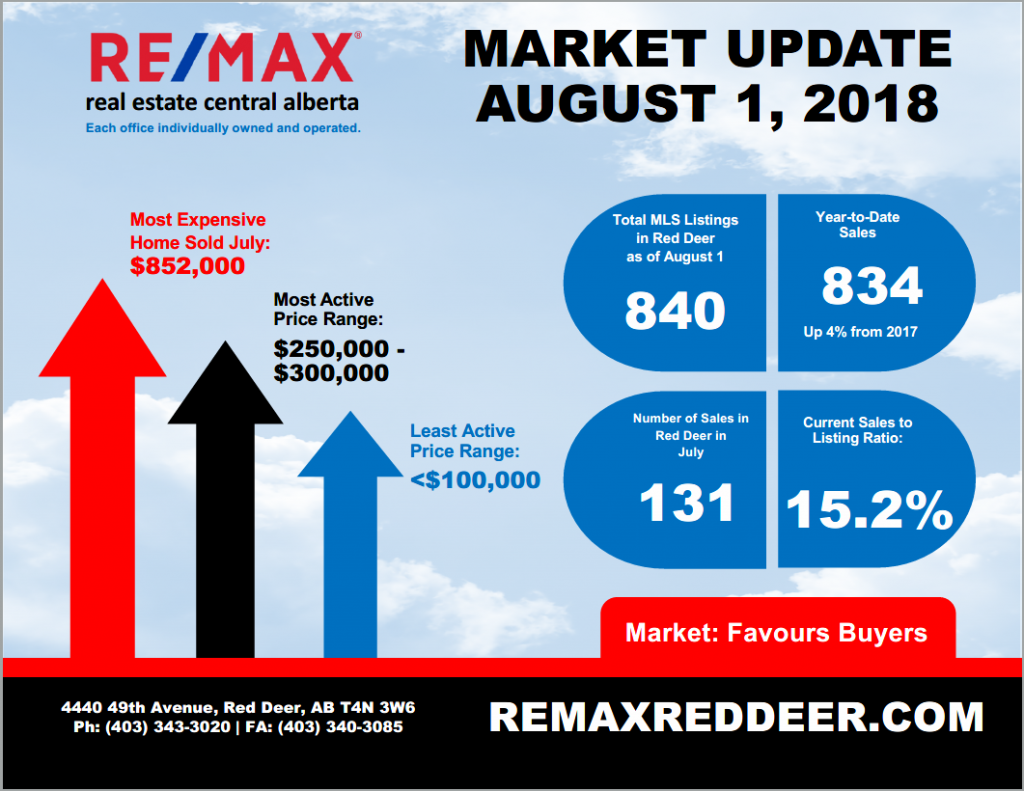

The usual summer trend to lower sales in July held true this year in every market we serve except Penhold which experienced a burst of activity. The other trend that we are seeing is the number of active listings finally starting to come down slightly. The sales to listing ratio in central Alberta continues to favour buyers, but we are finally seeing it easing its way toward balance.

Many of our clients are wondering why the market hasn’t rebounded more quickly when they are hearing that the economy is improving. A stronger economy is positive for sure, but that puts pressure on interest rates which directly impact the real estate market. Higher rates in conjunction with restrictive Federal Government imposed mortgage rules are making it difficult for buyers. Many have opted to stay put because they can’t qualify to move up. And, move up buyers are a huge, missing piece of the puzzle.

Today’s real estate market is like a huge wheel that is stuck and needs a nudge to get it moving. Once it starts to turn, momentum will help it keep turning. Some relaxation of the mortgage requirements or easing of rates in Alberta would be the grease that makes it easier to get unstuck. Neither option seems very likely, so we will have to be patient and accept things the way they are for now.

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – August 1, 2018

July 25th, 2018 by Dale Russell

Tags: Red Deer real estate market update

Posted in Monthly Market Update | Comments Off on MARKET UPDATE – July 15, 2018