November 25, 2011 – Weekly Market Report

Friday, November 25th, 2011Market Update – Good things continue to happen in Alberta. For several weeks now, we have been highlighting good news stories about Alberta’s economy. I am starting to run out of new headlines.

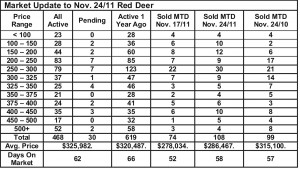

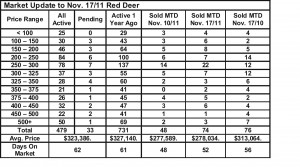

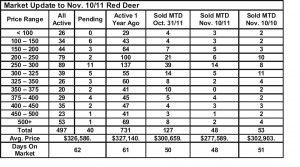

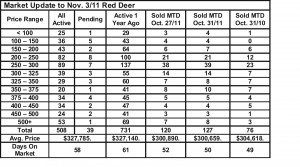

The market seems to be staying busy going into the middle of November. As I mentioned over the past few weeks, the relationship between supply and demand has changed over the last few months with the gap narrowing rather than widening.

Active listings in Red Deer number less than 500 for the first time since the summer of 2007. Sales have not recovered to previous levels, but are certainly better than last year (up over last year by 20% in our MLS Board area).

There is new confidence the Keystone pipeline will be approved which is very good news for Alberta. It’s still not guaranteed of course. Environmental groups are fighting it, but the reality is that our oil is going to be needed as conventional supplies dwindle. The article below suggests that Alberta businesses are very confident about our future.

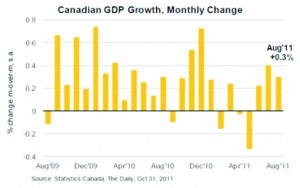

The Beat of Its Own Drum – Dan Sumner, Economist, ATB Financial – Indicators for economic activity in Alberta during the third quarter have come up roses so far, and this morning another sign the economy is humming along with wholesale trade rising to its highest level on record.

Alberta wholesalers brought in $6.13 billion in revenues in September, the highest amount on record and only the second month in history above the $6 billion mark. During September wholesale activity rose 2.0% and is up 12.1% from a year ago, the second largest gain of any province behind Saskatchewan (+22.5%).

After plummeting during the recession it has been a nearly straight line upwards for wholesale trade in Alberta (see graph). Activity in the sector is one of the few that has definitively regained its pre-recession peak (unlike manufacturing shipments exports and vehicle sales, for instance)

Wholesale trade gives an indication of purchases by businesses. If wholesale trade in Alberta is strong it means firms in the principle industries (energy, agriculture, forestry, retail etc.) are out there spending money and in turn expect their sales to grow.

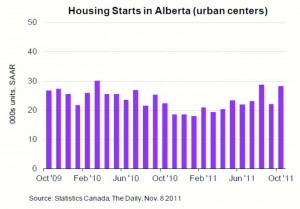

Wholesale activity for the third quarter joins a host of other indicators (employment, manufacturing shipments, vehicle sales, building permits, housing starts and exports), which all show the Alberta economy picked up during Q3, despite all the turmoil in the global economy.