MARKET UPDATE – June 15, 2017

Tuesday, June 27th, 2017The central Alberta real estate market has been following similar trends for many years – slower in the winter, strong in the spring, a little slower in the summer and busy again in the fall. There are some reasons for those trends. The spring market probably has been the strongest because that’s when oil workers came home at break-up and had some extra time to look at houses and make a move before going back to work.

December and January are slow for obvious reasons – most people don’t have time to move during the Christmas season and many don’t like to move in the winter.

The last half of June and the summer months are also times when many people have other things on their minds – the end of the school year, summer holidays etc.

September, October and November can be quite busy, although rarely as busy as the spring market.

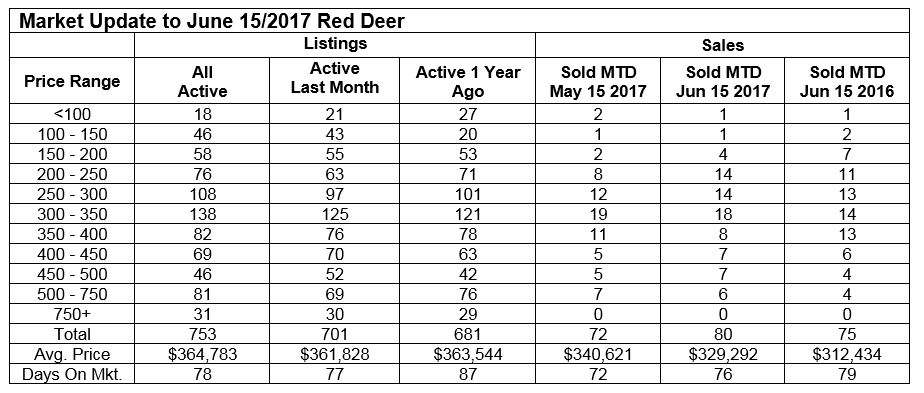

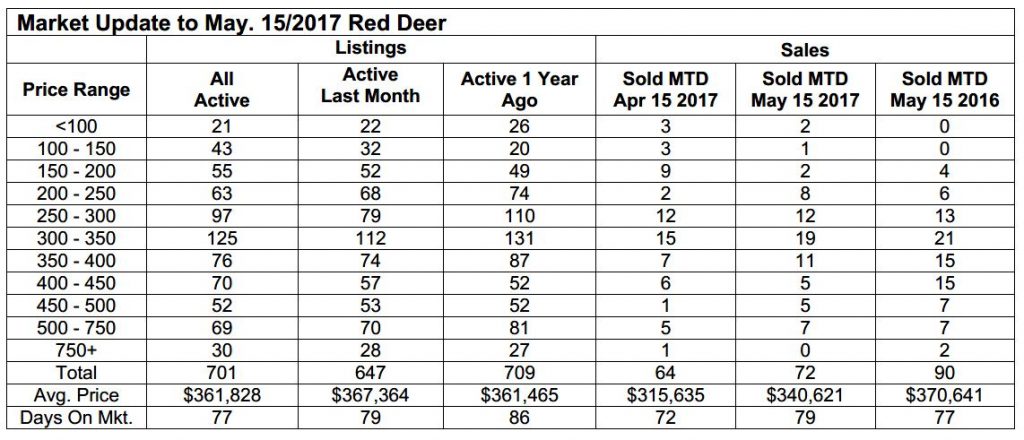

This year, the spring market has not reached levels seen when oil prices were high and the economy was booming. We have now experienced two and a half years of low oil prices and a slower economy and it shows in the real estate market. Sales are lower and the number of active listings is higher, which leads to softer prices.

There is evidence that the economy is turning. Alberta is projected to lead all Canadian provinces in growth this year with GDP predicted to increase by 3%.

So, when can we expect to see a stronger real estate market? Obviously it depends on oil prices to a large degree, but the real estate market in the last few downturns has always taken at least a year to recover.

That would mean that we could see a return to more normal sales numbers in the spring of 2018. In the meantime, we expect to see sales and the listing count keep pace with last year and maybe even do a little better.

Again, the good news for those buying and selling in our market – sell low, buy low. If the house you are selling goes up, the one you buy will go up as well. Now is the time to take advantage of the large inventory of homes and the vast choices available as well as very favorable interest rates.

Real estate has always been a great investment. It provides a place to live while growing in value and best of all, the profit at the end is realized TAX FREE! There just isn’t a better place to put your money.