July 15 2015 – Market Update

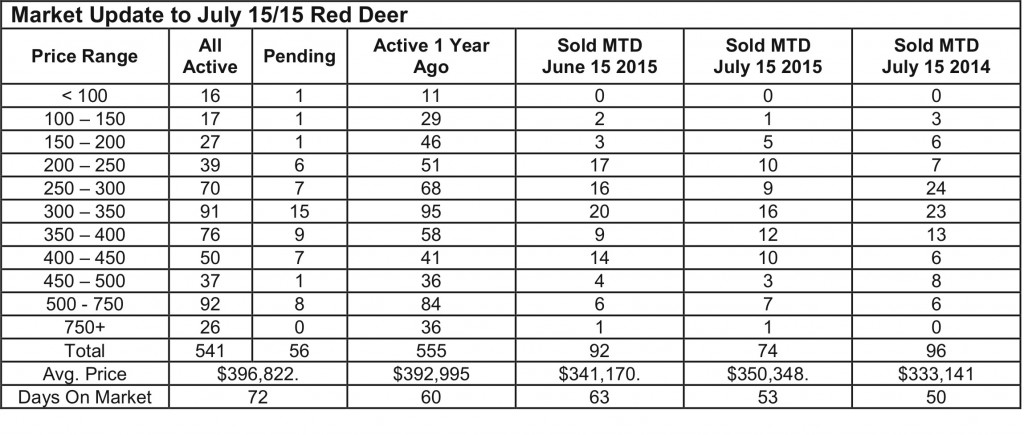

Monday, July 27th, 2015Red Deer Market Update – Sales in the first half of July were down from the same period in June which is normal. July

and August are typically a little slower months with people focused on summer activities. The number of active listings

dropped compared to the same time last month, keeping the ratio between supply and demand in balanced territory,

where neither seller or buyer have an advantage.

Sales appear to be nicely spread across the price spectrum with adequate inventory to satisfy most buyers in every price

range. The pending sales count is also down slightly from this time last month, but still well within the “normal” range.

The price range where buyers have the most options and the least competition is over $500,000.

The Bank of Canada dropped its lending rate this week by another 0.25% to 0.5% which put downward pressure on the

Canadian dollar. In the meantime, the US Government brokered a deal with Iran that would see some of their financial

sanctions eased and allow them to start producing and selling more oil into the world market. That agreement was

probably at least partly responsible for oil prices dipping very close to the $50 mark.

It seems the economy was adjusting well to $60 oil. $50 may not be high enough to keep oil companies investing in new

projects. Many of the workers laid off in January have been trickling back to work, but a protracted spell of much lower oil

prices could put them back on the sidelines. There is still much good news out there however. The Treasury Branch

article below provides proof that the Alberta economy is not solely dependent on oil prices.

Construction activity holding up – Todd Hirsch, Alberta Treasury Branch

Despite the economic downturn, the roar of bulldozers, jackhammers and cement mixers was just as loud over the second

quarter as it’s ever been in Alberta. The total value of non-residential spending was $2.73 billion from April to June,

essentially unchanged from the first quarter. Compared to the second quarter of last year, spending is actually up five per

cent.

Commercial projects—one of three non-residential building construction categories—slipped to $1.86 billion. That’s down

from previous quarters, but not dramatically so. Commercial building projects include office towers, hotels and shopping

centres, and account for the largest share of total non-residential spending. Given the current pace of construction in

downtown Edmonton and Calgary, it’s not surprising that spending on commercial projects has yet to see much pullback.

Government and institutional spending rose slightly to $512 million, the highest level since early 2011. Industrial projects

were essentially unchanged at $359 million.

While non-residential building activity has held up remarkably well during the current economic downturn, it is expected to

slip further as the year progresses. Many of these projects, particularly the large commercial office towers, were planned

and started well before oil prices started to fall a year ago. Once started, construction spending generally continues until

the project is completed—which sometimes takes several years.

Even with more pullback expected in the coming quarters, spending on commercial projects is likely to hold up reasonably

well—especially compared to the much sharper downturn in 2009.