June 15, 2016 – Market Update

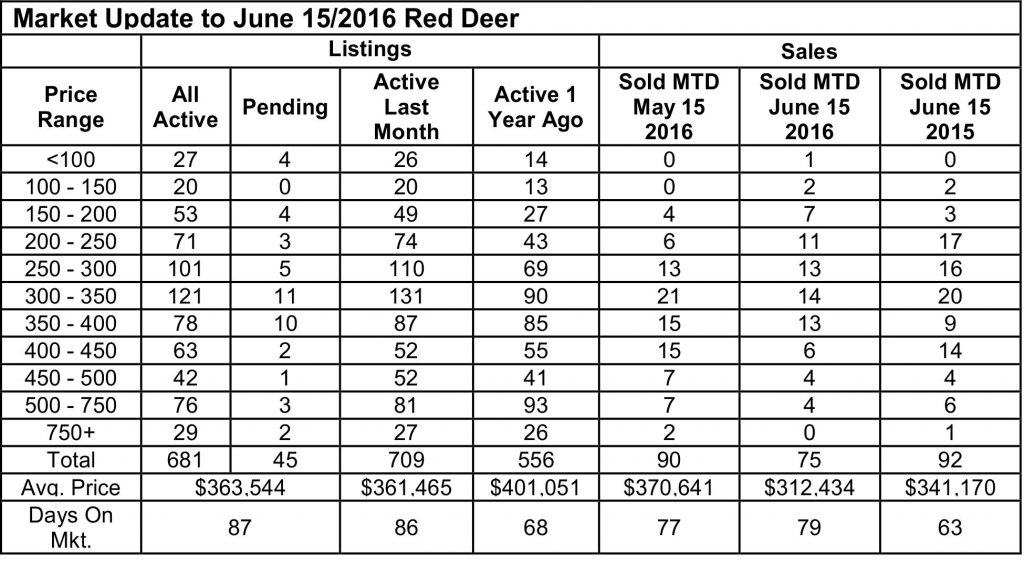

Saturday, June 25th, 2016Sales in the first two weeks of June were a little slower than last month as well as the same period last year, but there are two encouraging signs that the market is on the right track. First, the number of active listings has dropped since last month. Second, the number of pending sales is still strong, even though recent changes to regulatory policy allows sellers not to report pending sales. That means that there are likely many more pending sales than actually show in our records.

We consider the overall central Alberta market to be stable considering the economic situation in Alberta. That stable market can probably be at least partly attributed to the fact that people are staying here rather than leaving, as indicated in the ATB article below. Apparently the job situation in other parts of Canada isn’t good enough to lure them away and they feel there is a future here.

Crude oil prices have fallen below the magical $50 US mark, which may be having some effect on consumer confidence. We expect them to fluctuate up and down but most economists are predicting a gradual rise over the next few months and improvement in the Alberta economy starting this summer and fall.

Out-migration from Alberta Holding Steady, Todd Hirsch, ATB Economics – During a typical recession in Alberta, it’s common for people to move to other provinces for work. That trend makes what’s happening in the current downturn a bit surprising: so far the number of people leaving Alberta is relatively low.

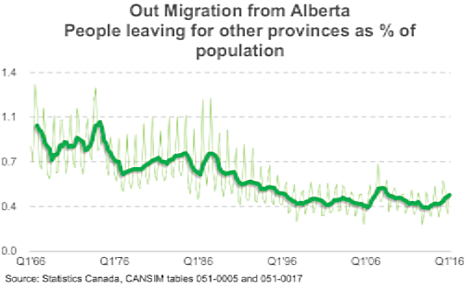

The graph below shows the last 50 years of out-migration to other provinces, as a percentage of the population. The thin green line shows quarterly outflows that are subject to significant seasonality—people tend to leave mostly in the third and fourth quarters of the year. The heavy green line shows outflow averaged over four quarters, giving a better perspective of the general population movement.

The outflow was quite high during some of the 1960s and 1970s—more than one percent of the province packed up and left. The outflow gradually ebbed lower over the decades, with only a slight bump higher during the nasty recession of the 1980s.

The percentage of Albertans leaving has been remarkably stable since the mid-1990s at around 0.4 per cent per quarter. There was a slight jump in the 2008 recession to around 0.5 per cent. Despite the severity of the current 2015-16 downturn, out-migration from Alberta has risen only slightly above 0.4 per cent—mostly due to the fact that the job market in other parts of the country is not significantly better than it is in Alberta.