September 2, 2011 – Weekly Market Update

Wednesday, August 31st, 2011Our Other Economy

We analyze and discuss the energy industry endlessly for signs that all is well in central Alberta. But, there is another, very important economic influence in central Alberta that we often overlook. Farming has been a major part of our local economy since Alberta was settled in the late 1800’s.

When farmers do well, the income they generate trickles into the economy in numerous places and helps fund an abundance of service jobs. World grain production has slipped in recent years while demand has increased with population growth. Like all commodities, when supply decreases and demand increases, prices go up.

Alberta Farmers Anticipate Strong Crop Production – ATB Financial

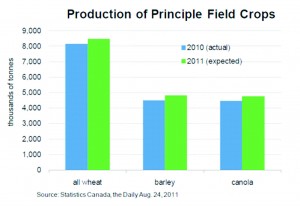

Farmers in Alberta expect to harvest larger amounts of wheat and barley compared to last year, as well as a record amount of canola. Statistics Canada reported on Wednesday that according to a survey of 15,200 farms conducted between July 25 – August 2, production of all three principle crops in Alberta (spring wheat, barely and canola) is expected to rise from last year. This rise in production is thanks partly to hot, dry weather that has offset production losses due to adverse weather conditions at the start of the year. Total wheat production is expected to rise 3.8%, while barley and canola production are expected to climb 6.5% and 6.0% respectively.

This year is gearing up to be a strong crop year for many farmers in Alberta as relatively positive growing conditions across most regions of the province combined with fairly robust prices may lead to healthy jump in crop receipts. The healthy harvest in Alberta is positive news not only for farmers but also the entire Alberta economy as a strong influx of cash from crop receipts will have positive trickle down effects on the broader economy. Farmers in Saskatchewan also expect crop production to rise year despite a tough start to the 2011 crop year. Farmers in Manitoba, however, expect large declines in production of all three crops as very wet weather conditions prevented many farmers from getting their crops seeded.