October 28, 2011 – Weekly Market Report

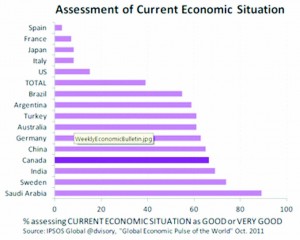

Monday, October 31st, 2011Just like we’ve been saying, things in Canada are very good compared to

the rest of the world, at least according to the ordinary Canadians in the

survey results below. The sense of comfort we have with our current

economic conditions contributes to a healthy housing market.

Folks who believe the economy is good or very good invest in homes,

invest in their businesses, hire people, do research and development to improve

their businesses, and all those things are what contribute to a healthy

economy.

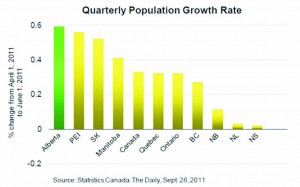

Canadians Think Economy is OK – Todd Hirsch, Senior Economist,

ATB Financial

A quick scan of recent international business news headlines suggests much more worry than optimism, and that worry is reflected in a global survey of attitudes.

Canadians, however, stand out with relatively upbeat attitudes.

IPSOS’s “Global

Economic Pulse” is a survey of participants in 24 countries around the world,

assessing the current economic situation in each country. The survey was

conducted between September 9th-19th.

In Canada, 66% of survey participants judged the Canadian economy to be

in GOOD or VERY GOOD shape at the moment. That puts us in #4 spot globally,

behind Saudi Arabia, Sweden and India. Canada outperforms such economic

hot-spots as China, Germany and Australia. On average, only 39% give their

country such a positive assessment.

Canadian attitudes

stand in sharp contrast to those of our American neighbours, where only 15%

believe the economy to be in good or very good shape. (See graph for top 10 and

bottom 5 countries).