November 16, 2012 – Market Update

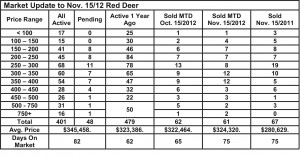

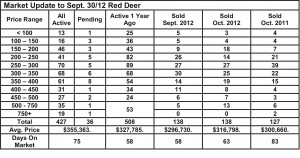

Friday, November 16th, 2012The Red Deer market continues to forge ahead with November sales keeping pace with September and October. In the meantime, the active listing count is still dropping, making it tougher for buyers to find that perfect home. If the trend to fewer active listings and strong sales continues, prices will start to adjust.

There is lots of optimism that two new pipelines to take oil to eastern Canada and the US are imminent, natural gas prices are rising and it looks like the future is bright for Alberta.

Small is Beautiful – Todd Hirsch, Senior Economist, ATB Financial – Small- and medium-sized businesses (SMEs) are the heart and soul of many communities throughout the country. In fact, nearly 95 per cent of companies in Canada are considered small or medium in size. Given that, it’s a good thing that their business optimism is turning higher.

According to a survey conducted monthly by the Canadian Federation of Independent Business, the index of confidence among SMEs in Alberta rose to 72.2—more than a full point higher than the reading of 71.1 in September. On balance, Alberta businesses are more optimistic than the Canadian average, but the national figure did rise by a larger amount in October (from 62.0 to 65.6). Businesses in Newfoundland and Labrador continue to be the most optimistic, followed by Alberta and Saskatchewan.

Measured on a scale of 0 to 100, an index level above 50 means owners expecting their businesses’ performance to be stronger in the next year outnumber those expecting weaker performance. According to past results, index levels normally range between 65 and 70 when the economy is growing at its potential.

The high level of optimism in Alberta is attributable to relative stability in the oil and gas sector, as well as the other supporting industries throughout the province such as agriculture and forestry. A significant number of SMEs in Alberta are in the construction and energy sectors, and with those performing well at the moment, it is little wonder that independent entrepreneurs are seeing good days ahead.

Alberta’s housing starts hanging in, Todd Hirsch, Senior Economist, ATB Financial – Despite the anxieties in Europe, uncertainty in the U.S., and a faltering economy in other parts of Canada, Alberta remains remarkably stable. The province’s balanced housing market has been one of the most convincing indicators of that.

Construction got started on 33,127 new homes in Alberta last month (adjusted for seasonality). That is essentially unchanged from September. Over the first ten months of 2012, total housing starts are higher by 33 per cent over the same ten months of last year—a significant increase given the slowing of the housing market elsewhere in the country.

Nationally, housing starts slipped to 204,107 units, down from 223,995 in September—lower than the consensus forecast of 213,000. However, Alberta’s housing market has held up better than most other provinces. The number of starts in October is only slightly below the 10-year average for the province (34,800). And if you omit 2006 and 2007 from the calculation—the two record-setting years for housing starts—last month’s figure is actually higher than average (31,300). A strong labour market, high average wages, and surging consumer sentiment have helped keep Alberta’s housing market on its feet. But almost most importantly, the province is once again a strong attractor of inter-provincial migrants—many of them moving to Alberta to find work. On a net basis, over 20,200 people from other provinces have moved to Wild Rose Country over the first half of 2012. That alone provides some strong incentive for home builders to keep swinging their hammers.