Red Deer Market Update – Feb 25/11

Friday, February 25th, 2011Canada’s Economic Balance Tilting West February 18, 2011 – Todd Hirsch – ATB Financial

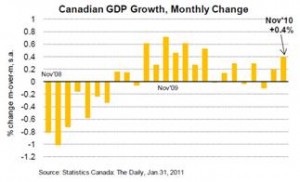

It’s been ongoing for decades already, but the westward drift in Canada’s economic centre of gravity will gain even more momentum in 2011. Here are the top ten reasons why.

10. Better fiscal environment: Saskatchewan is running a surplus. BC and Manitoba are close. And while Alberta is still running a pretty hefty deficit, the province is debt free and has plenty of savings to dip into. Ontario, on the other hand, is in some trouble. It’s not comparable to Greece (as some commentators have suggested), but big spending cuts and/or tax increases will eventually hit the province—and probably Quebec, too.

9. Agriculture: It doesn’t happen too often, but crop farmers in western Canada may actually be smiling this spring. If moisture conditions hold up (and the snow pack this winter suggests they will), it could be a very good year for wheat, barley and canola growers. Prices are stellar.

8. More diversified exports: The western provinces are somewhat more oriented towards China, India and the emerging economies than are points east of the Manitoba- Ontario border. This is especially true in BC, which sent only 45% of its exports to the US in 2010 (compared with 80% from Ontario). Even the Prairie Provinces, with all their energy exports piped south of the 49th parallel, sent slightly less to the US (78%). With the emerging economies leading global growth, the broader trade diversity in the West will be a solid benefit.

7. The soaring loonie: related to #8 above, the higher Canadian dollar will be a disproportionately painful kick in the face to central Canadian exporters whose bread and butter is the US market. The story is really not so much about the loonie but about the US Greenback, the depreciation of which few think is quite over just yet.

6. Fort McMurray: The oilsands have generated more than their fair share of controversy and problems, but the largest engineering projects on the face of the earth have taken on a life of their own. That is lifting not only the fortunes of northeastern Alberta, but the manufacturing heartland of central Alberta as well. A new upgrader near Edmonton is set to be built.

5. Conventional oil drilling: not to be outdone entirely by the glow of the oilsands, western Canada’s conventional oil drillers are having a great year too. Forecasts for wells drilled have been revised upward for 2011. Prices well above $US 80 per barrel certainly help. But improved technologies in horizontal drilling— many of which were developed in Alberta—are giving new life and adding reserves to oil fields drilled decades ago.

4. Non-oil resources: with the exception of natural gas, almost all of Canada’s natural resources are enjoying high prices in 2011. The world needs ‘em, and western Canada’s got ‘em! That will boost activity in potash, base metals, and even forestry.

3. Jobs, jobs, jobs: Through the recession, employment in Saskatchewan and Manitoba didn’t even drop, and with the recovery in 2010, job creation has picked up. BC’s hit a soft patch post Olympics, and Alberta suffered the worst hit (proportionately) during the downturn. But through thick and thin, unemployment rates across western Canada remain lower than in central or Atlantic Canada. That will help pull job seekers to the West.

2. Growing cities: they may not be the size of greater Toronto or Montreal, but western Canada’s urban municipalities are showing some of the fastest growth rates in the country. Saskatoon took the top spot as the fastest growing population in Canada, and two other western Canadian cities—Vancouver and Regina—placed #2 and #3.

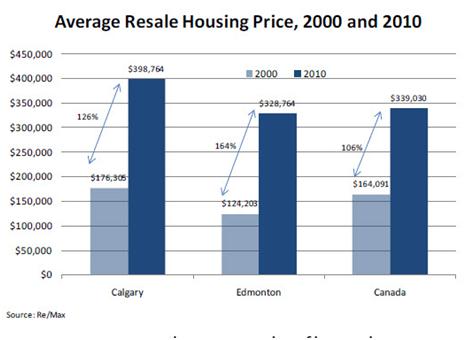

1. A global glow: with the surge in mergers, acquisitions, and equity sales for Canadian energy companies, Calgary is gaining tremendously in global investment banking. According to a study by one large global financial player, Canada now ranks fourth in the world (behind the US, UK and Japan) in terms of generating investment banking fees. Toronto still accounts for the lion’s share of that. But the big growth has been in Calgary as big players like Barclays Capital, Credit Suisse, and Citigroup scoop up talent and office space.

All of this will put western Canada on top of the national growth chart in 2011—and indeed in an enviable position among most of the global economies.