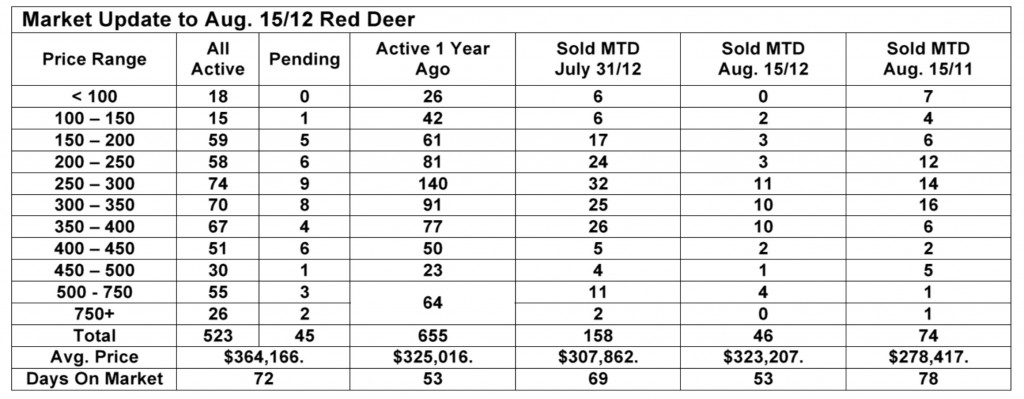

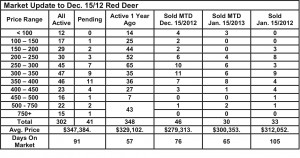

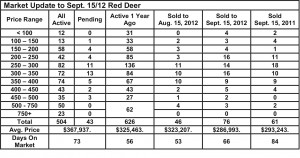

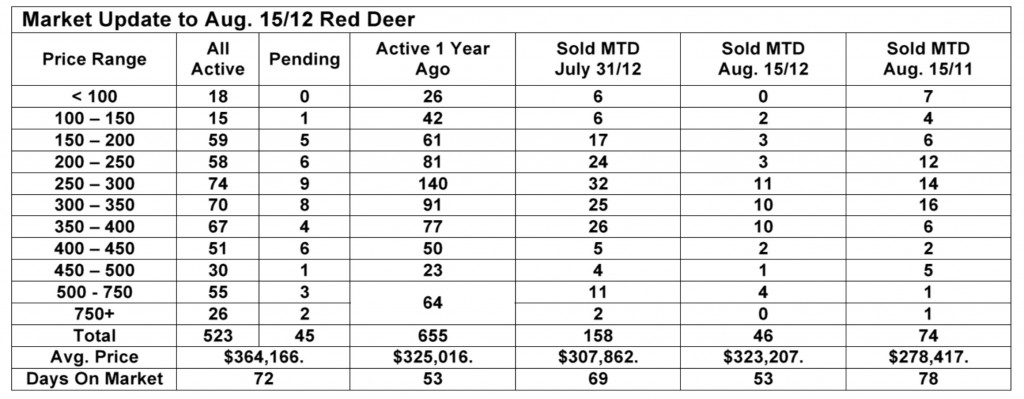

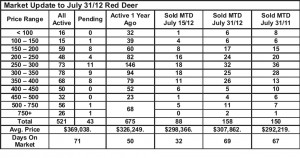

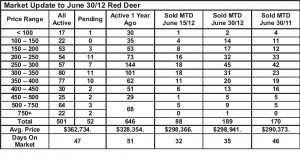

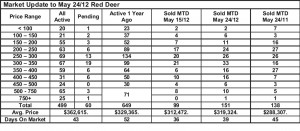

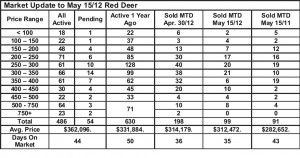

Market Update – Month to date sales in Red Deer in August have slowed considerably compared to the same period last year and it’s unlikely we will reach the levels achieved in July. Some of that is probably due to the very nice summer weather we’ve been experiencing. As you can see from the articles below, the job situation in Alberta is very

healthy which should translate into a healthy housing market.

Our other central Alberta markets are experiencing much the same conditions with the exception of Sylvan Lake whichmay be benefitting from the nice weather and the resulting heavy lake traffic.

Oil prices have been gaining ground recently with prices hovering around $90 per barrel. While that doesn’t translate into good news at the pumps, it certainly is good news for energy

sector employees in central Alberta. We expect a good fall for the central Alberta housing market – an adequate supply and strong demand which equates to a balanced market, but very little increase in prices.

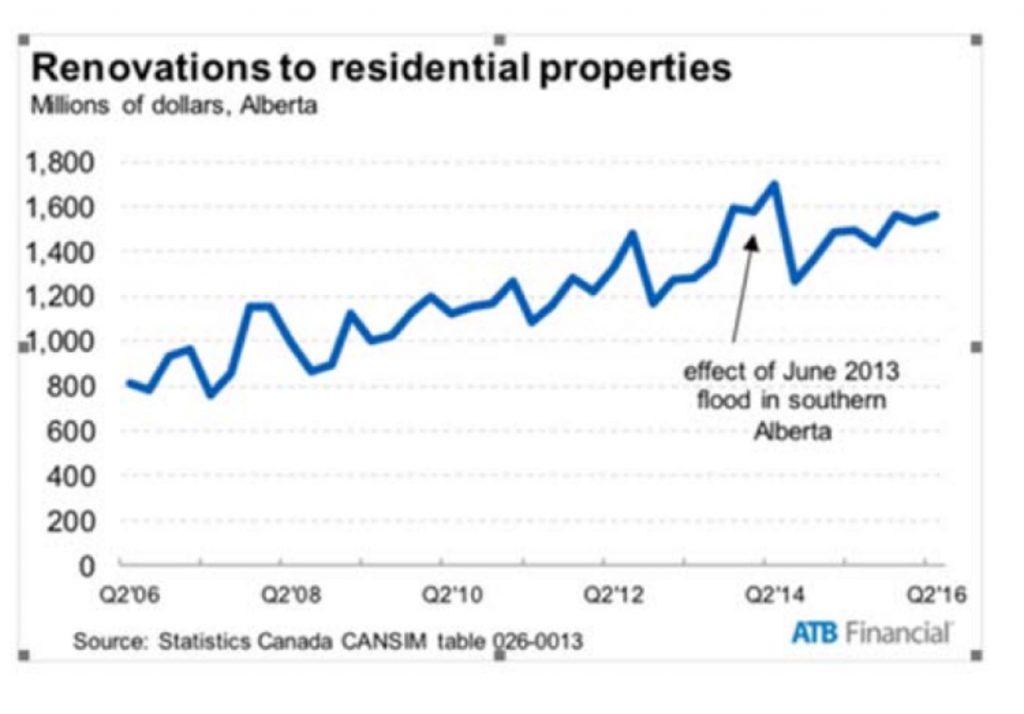

Excerpts from ATB Financial Daily

Economic Comment by Todd Hirsch, Senior Economist

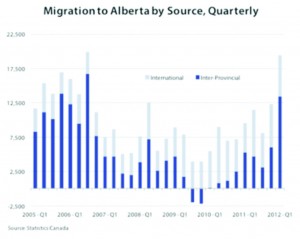

Aug. 13, 2012 Full and Part Time Work – Last week Statistics Canada released the latest Labour Force Survey, which showed Alberta gained about 5,800 jobs in July. But not all jobs are the same—economists like to see gains in full-time positions as assign of a healthy economy. On that front, Alberta is doing just fine.

In July 2012, there were just under 1.8 million people working in full-time jobs in the province while there were only 351thousand working part-time. Compared to the previous month, full-time jobs were up by about 15,300, whereas there were actually 9,600 fewer part-time jobs.

Aug 14, 2012 – How Good Do We Have It? Most job seekers in this province know firsthand that times are good and finding work is generally not too difficult.

But Albertans may be surprised to hear that compared to many other places in the developed world— things are more than good—they’re great!

The Organization for Economic Cooperation and Development (OECD) tracks and reports the unemployment rate among the advanced, wealthy countries of the world. Given all of the economic uncertainty in many parts of the globe at the moment, these rates vary wildly.

Currently the highest unemployment rates among the OECD countries are found in Europe, with Spain taking top (bottom)honours at 24.6 per cent unemployment— basically, one in every four Spaniards is without work. Greece comes in second with an unemployment rate of 21.9 per cent, followed by Portugal at 15.2 per cent. Overall, the European Union is

grappling with unemployment of 10.3 per cent.

At the other end of the spectrum is Norway. Its oil fuelled economy means that only 3.0 per cent in that country are out of work.

The Asian OECD countries of South Korea and Japan also enjoy extremely low rates (although Japan’s overall economy is not performing that well).

If it was counted separately as an OECD country, Alberta would find itself in very good company. With an unemployment rate of4.5 per cent in May, it would rank as the fourth best place in the industrialized world in which to be looking for work.