January 15, 2017 – Market Update

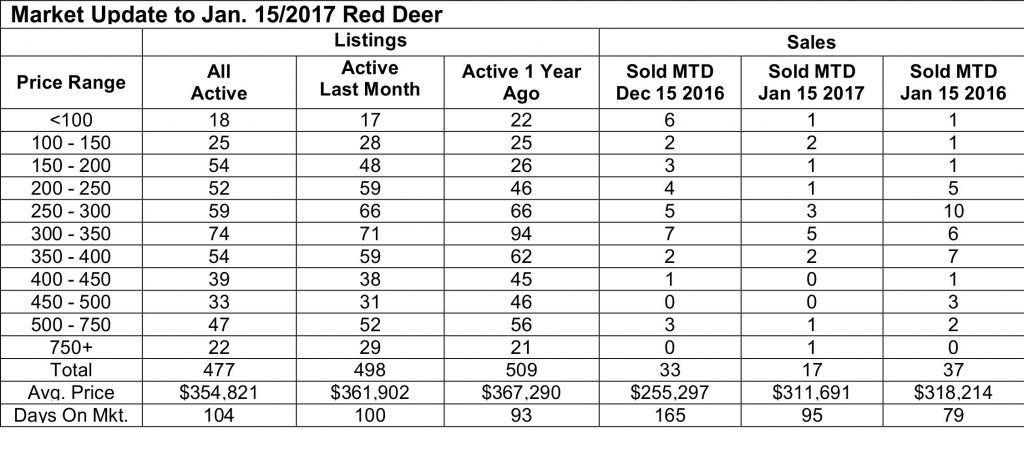

Thursday, January 26th, 2017The housing market in central Alberta is off to a slower start, very similar to what we experienced in 2010, a little less than two years after the September 2008 economic crisis. The general consensus in Alberta economic circles is that we are starting to turn the corner, and things should improve this year, but a little slower than the last recovery.

The housing market generally lags behind an economic recovery by at least a year, so we don’t expect 2017 to be a boom year for sales or prices. We do expect to see a marginal improvement as the economy continues that slower climb back to wellness.

What does this mean for home sellers? It means they will have to be reasonable around their price expectations. Price is determined by the relationship between Supply and Demand. While the Supply of available homes is lower than it’s been for a couple of years, it’s still too high in most central Alberta markets to get them close to balance. The homes that show the best and are priced competitively will sell and the rest won’t.

What does this mean for home buyers? The first thing home buyers need to understand is that prices come down very slowly. While the housing market is slower, the vast majority of home sellers are not forced to sell, and won’t unless they receive a price they deem fair. Offers that are substantially lower than market value won’t fly. The huge advantage home buyers still have, are historically low interest rates and a good supply of homes to choose from. It’s a great time to invest in a home.

What does this mean for both buyers and sellers? We are not in a crisis. Home values have softened some, but Supply and Demand are not so far out of balance that Sellers should expect to give their property away and buyers should expect more moderate prices, but not a fire sale.

For those consumers selling and buying in the Alberta market, it’s important to remember that the whole province is floating in the same real estate pond. To a large degree, the level of that pond rises and falls at the same rate. If you are selling at a price that you perceive to be low, you should also be able to buy at a price that is relatively the same, therefore there is no loss or gain, other than you are now living in a home that suits your needs better.

Owning a home is much more than an economic endeavor. In Alberta, our homes are necessary to keep us warm and out of the elements, but they are also the place where we live and raise our families. The housing market in Alberta will survive and thrive in spite of economic ups and downs.

At RE/MAX real estate central alberta, we want to be consultants for our clients, providing sound information, good advice and a competent guiding hand through the increasingly complex process of buying or selling your home. Call us first!