January 15 2015 – Market Update

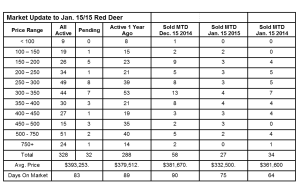

Friday, January 16th, 2015Red Deer Market Update – sales in the first two weeks of the New Year are off from the same time in December but close to the first two weeks of January 2014. The number of active listings is slightly higher than it was a year ago, but normal for this time of year.

We are consistently asked how oil prices will affect the housing market. House prices, like oil and everything else in the world that is sold in an open market, are dictated by supply and demand. The reason oil prices are low is that supply has been growing faster than demand. When oil (and house) prices go down, a couple of things happen – demand goes up and supply goes down, eventually bringing supply and demand back into balance.

We don’t have a world recession. The American economy is strong. We still have low interest rates. Many industries and most consumers benefit from lower fuel prices and a lower Canadian dollar. Yes, there will be some slowdown while oil prices sort themselves out, but we will still have an economy that will perform as well as most other Canadian provinces according to all of Canada’s major banks. The question is, “is the glass half full, or half empty? We think it’s half full!

Typically it takes a little time for the law of supply and demand to work its way through the economy, but it always does. We have been through these situations before and always come out stronger and better equipped to handle the next one. If there is a nice thing about the current situation, it is that we are just dealing with an imbalance in the supply of and demand for oil.

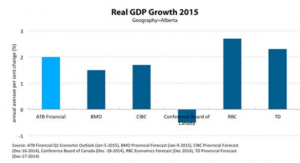

Not all forecasts see Alberta’s economy the same way – Todd Hirsch, Chief Economist, ATB Financial

With oil prices plummeting in recent months, there’s been intense interest in how Alberta’s economy will fare in 2015. Although economists wished we had a crystal ball, we have to settle for our best guesses and insights to forecast how things may turn out—and here there is some disagreement.

The graph below shows the most current forecasts from some of Canada’s largest and most closely followed economic forecasters. They generally show an expectation of real GDP growth to be somewhere around 2 per cent—a far cry from the 4 per cent growth that the province has managed over the last several years.

One outlier that’s been attracting a lot of attention is the forecast from the Conference Board of Canada. They now expect Alberta’s economy to be in an outright contraction this year—in other words, a recession. If that happens, it will be the first time the province’s economy has shrunk since 2009 when it fell by 4.2 per cent.

Of course it’s impossible to say for sure if the Conference Board’s forecast is correct—or if any of these forecasts are correct. And it’s normal for there to be some varying opinions about how far low oil prices will drag down the economy. But while economists don’t always agree, they are all in unison about one thing: Alberta’s economy is set to slow significantly in 2015.