July 15, 2016 – Market Update

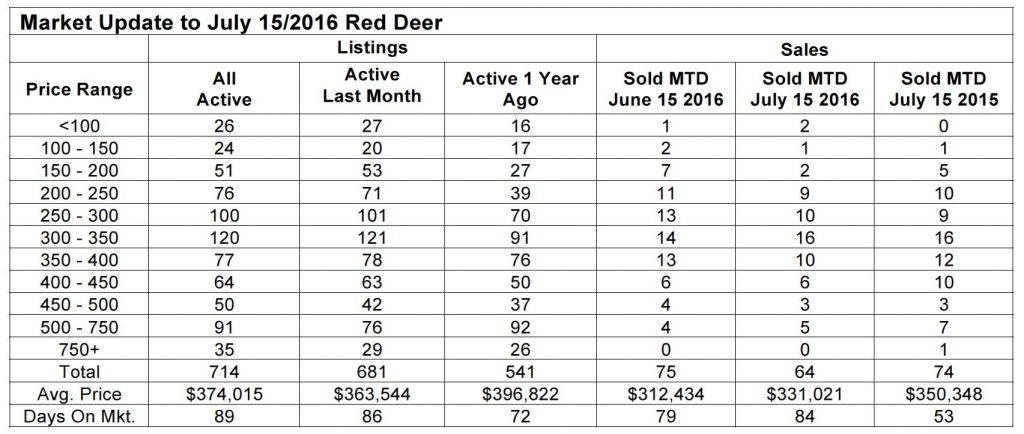

Thursday, July 21st, 2016Red Deer – a little slower start to the summer market in Red Deer with sales in the first two weeks of July down from last month as well as last year at the same time. It’s a bit of reversal from the last couple of months when we were seeing positive signs – higher sales and slow inventory growth. Sales do typically slow somewhat as we move into July and the decrease isn’t far off typical.

It seems that history does repeat itself. The number of active listings is creeping up to levels we last saw in 2010 – 2011 while sales for the first half of the year are on par with those in 2009 and 2010. Coincidentally the price of oil was below $50 at the beginning of 2009, and the difference between then and now is that the price did recover back to $US 80+ within just a few months.

The one thing we do know is that the world is still using lots of oil and will do so for many years to come. That means there will be a market for Alberta oil. Left alone, the market will always find balance between the place where consumers are willing to buy it and producers are able to bring it to the market. This time, we don’t expect prices to recover as quickly, but we do expect to see producers become more efficient in order to generate profits even at lower prices.

Alberta Treasury Branch – Alberta Economic Outlook – Q3 2016

Without question the third quarter of 2016 is going to be difficult for many Albertans and businesses in the province. More layoffs in the energy sector and the setbacks presented by the Ft. McMurray disaster will add strain to an already struggling labour market. Adding to this is the heightened level of volatility in global markets and the questions surrounding the Brexit vote, all of which will continue to grind on optimism.

Yet while the unemployment rate may drift higher over the summer and early fall, there are signs that better days aren’t too far off. Oil prices have stabilized and should rally modestly to the range of $US 55-60 by the end of the year, which will bring stability to Alberta’s petroleum sector and the labour market. And barring any additional turmoil stemming from Europe (such as another major economy threatening to leave the E.U.) financial markets should calm down by the fall. In the meantime, Alberta’s retail, manufacturing, housing and construction sectors will continue to be challenged.

ATB’s economics and research tem are forecasting a contraction of 1.9 per cent this year – the second consecutive year of recession. This will be followed by a modest recovery of 2.0 per cent growth in 2017.