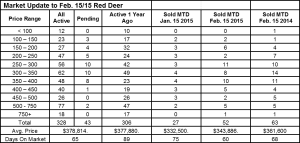

February 15 2015 – Market Update

Friday, February 20th, 2015Red Deer Market Update – a much better start to the month in February, almost as good as last year. Along with a strong sales count we see a higher than average pending sales count that should see us finish the month in very good shape. Active listings are up again, but in very good shape for this time of year and the market we are experiencing. In some central Alberta markets, sales have slowed from last year while the active listing count is up. It’s only normal that some buyers are holding off, waiting until they are sure their jobs are secure and for some indication where the market is going in the longer term. Unfortunately some irresponsible comments by the media and our provincial government about the length of the downturn and the size of the budget shortfall are causing more damage than the economy itself.

Read carefully and it’s obvious that a lot of the jobs cut by major energy producers are not all in Alberta and the ones that are here are mostly contractors. Many of those contractors will be able to fill some of those vacant positions that have been unfilled in the past. Only 25% of Alberta’s economy is derived from energy and not all the jobs are going away.

New ATB Poll finds: Albertans are keeping calm and moving on – Nick Ford – ATB From newspapers to TV screens, there’s been heavy coverage of Alberta’s current and future economic landscape. Politicians, journalists and economists have all weighed in but how do Albertans feel about the current state of the economy? ATB Financial asked this question and others to gauge consumer sentiment in its brand new bi-weekly Ear to the Ground poll.

Despite news of oil’s price struggles and a weakened loonie, 45 per cent of the survey respondents view the current Alberta economy as strong with 27 per cent of respondents perceiving our economy as weak. There are signs of worry amongst Albertans however. Over a third of Albertans anticipate that the economy will be weaker six months from now compared to about a quarter who believe it will be stronger. Additionally, close to 40 per cent of Albertans express intent to delay major purchases such as a house or car. And, 45 per cent are reconsidering travel plans. In general, Albertans are waiting for the dust to settle before deciding to make any large-scale purchases. This is likely tied to market uncertainty and the concern the economy might weaken in the next six months.

In general, Albertans are relatively optimistic about our economy. The latest retail sales numbers indicate that spending is still well above where it was two years ago. For now, Albertans will continue to trudge through the flurry of economic news stories.

ATB Financial’s most recent forecast projects that Alberta’s economy will grow by two per cent in 2015.