March 15, 2012 – Market Update

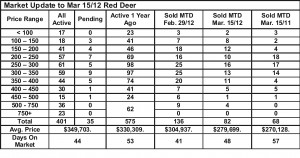

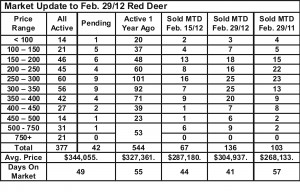

Tuesday, March 20th, 2012Sales and listing activity continue their positive track this month as we move into the busy spring market. Active listings in Red Deer are down more than 30% from the same time last year while sales are up 21%. The current sales to listing ratio so far this month is 40%. That means that 4 out of 10 homes on the market will sell this month. CMHA defines a Seller’s market as one where 3 out of 10 homes sell every month. When we reach a 40% sales to listing ratio, prices are starting to firm up. We have seen evidence of firming prices and a strong Seller’s market recently in the form of multiple offers on the same home and occasional sales over the listed price.

Where are we going from here? It appears that the world and US economies are weak but not faltering. Oil prices remain well over $100/barrel. Employment In central Alberta is growing. So, our local real estate market will continue to strengthen. Prices are on the way up and competition for well priced, well presented homes will be strong.

Western Employers to Ramp-up Hiring – Will van ‘t Veld Economist, ATB Financial

The national unemployment rate has been creeping up lately, but a look at hiring intentions over the coming months indicates that employers are optimistic that they will be expanding payrolls—especially in Western Canada.

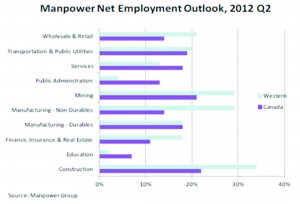

The Manpower Corporation is an employee staffing corporation with operations around the world. It conducts a quarterly survey, asking respondents how they see employment changing at their firm over the next three months. The net employment outlook is then computed as the difference between those firms that will likely be adding employees versus those that will be looking to reduce payrolls.

Nationally the seasonally adjusted net employment outlook stood at 13% for the second quarter of 2012, which is exactly where it stood a year ago. Construction and mining look to be the industries that will be doing the most hiring; the two industries that will barely increase hiring will be public administration and education.

Ontario has been struggling lately and hiring intentions there remain below the national average, although they are still positive. The non-seasonally adjusted (provincial numbers aren’t seasonally adjusted) net employment figure was 13% versus 16% nationally. On the more positive side, net hiring intentions in the beleaguered manufacturing sector look relatively strong, at 18%.

Unsurprisingly, the results out of Western Canada were by far the strongest, with net hiring intentions of 19%. Respondents in the West foresee a fierce hiring season in the construction (34%), non-durable manufacturing (29%) and mining (29%) industries. It won’t be rosy for everyone, however, with hiring intentions in the education (2%) and the public administration (4%) looking very tepid.