Red Deer Market Update – Jan 28/11

Friday, January 28th, 2011| Market Update to Jan. 27/11 Red Deer | ||||||

| Price Range | All

Active |

Pending | Active 1 Year Ago | Sold MTD

Jan. 20/11 |

Sold MTD

Jan. 27/11 |

Sold MTD

Jan. 27/10 |

| < 100 | 25 | 1 | 20 | 2 | 2 | 6 |

| 100 – 150 | 35 | 0 | 28 | 2 | 2 | 3 |

| 150 – 200 | 51 | 5 | 44 | 4 | 6 | 3 |

| 200 – 250 | 61 | 3 | 71 | 9 | 14 | 15 |

| 250 – 300 | 87 | 11 | 79 | 17 | 22 | 15 |

| 300 – 325 | 51 | 4 | 44 | 5 | 5 | 17 |

| 325 – 350 | 27 | 1 | 38 | 4 | 5 | 9 |

| 350 – 375 | 25 | 2 | 25 | 8 | 9 | 2 |

| 375 – 400 | 32 | 1 | 39 | 4 | 5 | 0 |

| 400 – 450 | 42 | 0 | 31 | 4 | 5 | 1 |

| 450 – 500 | 17 | 1 | 24 | 2 | 2 | 1 |

| 500+ | 54 | 3 | 51 | 1 | 1 | 1 |

| Total | 507 | 32 | 494 | 62 | 78 | 73 |

| Avg. Price | $323,712. | $323,250. | $297,996. | $287,716. | $266,027. | |

| Days On Market | 64 | 53 | 67 | 66 | 59 | |

New Year Brings New Confidence

Most of the economic news we are hearing lately is more positive than negative. Reports of slow recovery in the U.S. and even Europe are filtering in and it appears that more and more economists are finding reasons for cautious optimism.

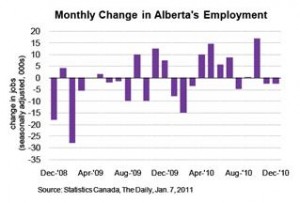

How does that affect us in central Alberta? A world wide economic resurgence creates demand for oil and natural gas. Increased demand generates higher prices, which motivates energy producers to spend money looking for oil and gas and then producing it. A very large portion of central Alberta’s economy is generated from oil and gas exploration, production and servicing.

While natural gas prices still languish on the bottom edge of the acceptable price spectrum, oil prices continue to hover around the $90 mark, high enough to support exploration and recent efforts to extract oil from shale in our western foothills.

Shale oil extraction requires expensive horizontal drilling and very large fractures of the shale and activity in that area will keep several large drilling and frac companies here busy.

We are now hearing reports that worker shortages are energy companies biggest concern. A shortage of workers will generate recruiting activity and bring new folks to central Alberta. New jobs in oil and gas create spin off service jobs and ultimately more population growth.

Population growth contributes to a healthy construction sector and the creation of more jobs and more economic prosperity.

Economic prosperity brings stability to the housing market. On the other side, housing market stability is one of the signs of a stable economy. Everyone dreams about the “good old” days when their home values were going up $10,000 per month, but that is not stability. That is a recipe for disaster. The price of homes can’t go up faster than wages because it’s wages that determine ability to own a home.

Stability is the key. The current situation in central Alberta is that while we are seeing increased activity in our housing market, we also expect to see a lot of the homes that didn’t sell last year come back on the market. That increasing supply will have a moderating effect on prices.

Recent steps by the federal government to further toughen financing requirements will also have some dampening effect on house prices. Some first time buyers may be kept out of the market and some will be forced to buy less expensive homes.

We see a return to a stable, balanced market that treats our buyers and sellers equitably and that suits us just fine.