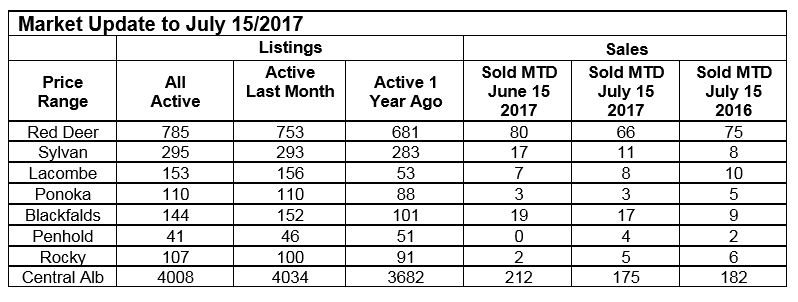

MARKET UPDATE – July 15, 2017

Thursday, July 27th, 2017STATISTICS FOR CENTRAL ALBERTA

INTEREST RATE CHANGES:

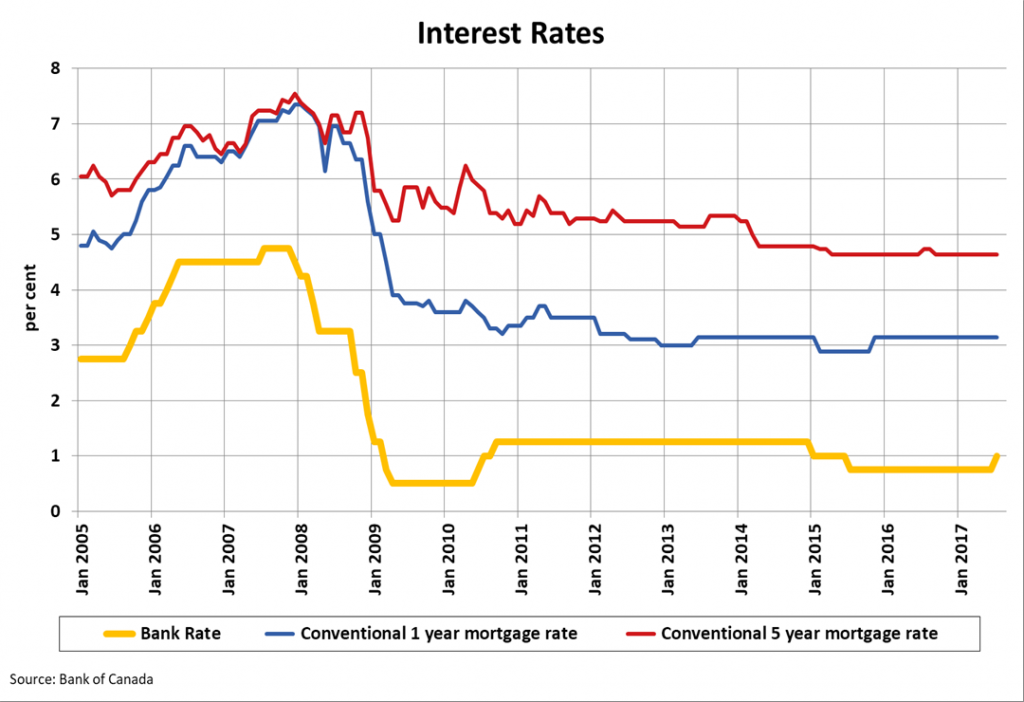

The Bank of Canada announced on July 12th, 2017 that it was raising its trend-setting overnight lending rate from 0.5% to 0.75%. The increase partially unwinds the half-percentage point by which the Bank dropped interest rates in early 2015 following the sudden drop in oil prices in late 2014.

When announcing that it was raising rates for the first time in seven years, the Bank recognized that Canadian economic growth has recently been coming in stronger than it had previously predicted and broadly based.

The Bank suggested future rate hikes will depend on whether economic growth continues to broaden and become more sustainable, whether soft readings on inflation prove to be temporary, and whether exports and business investment improve.

Even under these conditions, the Bank said it remains wary about risks to the Canadian economic outlook posed by protectionist U.S. trade policy and high Canadian household indebtedness. That means the Bank will be cautious about further raising interest rates.

As of July 12th, 2017, the Benchmark five-year lending rate used to stress-test mortgage applications stood at 4.64 per cent, which is unchanged from both the previous Bank rate announcement on May 24th and from one year earlier. That said, Canada’s major chartered banks have recently raised advertised five-year fixed mortgage interest rates by one-fifth of a percent to 2.84 percent – which translates into an increase of $50 per month on a $500,000 mortgage loan ($60 of per month on a $600,000 mortgage loan, etc.).

The next interest rate announcement will be on September 6th, 2017. The next release of the Monetary Policy Report, which will update the Bank’s economic forecast, will be on October 25th, 2017.