April 15 2015 – Market Update

Tuesday, April 21st, 2015

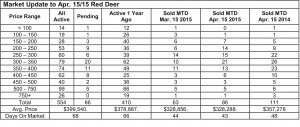

Red Deer Market Update – a great start to the month with 86 sales and 66 more that are pending. We aren’t quite where we were a year ago but keeping right up with the first two weeks of April 2012 and 2013. The total number of active listings is up slightly but mostly at the high end of the price spectrum. The number of listings actually dropped some of the low and mid price ranges.

There are markets inside every market. Supply and demand can favour buyers at one price range and sellers at another. In most central Alberta markets right now, sales are strong in the starter and move-up markets while things are slower in the higher price ranges.

The central Alberta real estate market seems to have avoided the dire straits predicted by media and the government so far this spring with “normal” sales and inventory levels when compared to the last five years. Comparisons with last year are down, but 2014 was the best year since the heady days of 2007 and should be considered in that light.

The Alberta Treasury Branch recently released its Alberta Economic Outlook for the 2nd Quarter of 2015. While there is unquestionably some pain as a result of the downturn in energy prices, their forecast is more optimistic than many and we think presents a reasonable scenario going forward.

Key results from the ATB Economic Outlook are:

- Alberta’s economy will slow significantly in 2015 with real GDP growth of 0.8 per cent

- Labour markets are being affected by rising unemployment

- Consistently weak oil and gas prices have curtailed investment in the energy sector

- Housing starts remain stable, but softness in residential real estate suggests construction activity will cool

- Net interprovincial migration will slow but should remain positive – a net gain of 40,000 in 2015

The same report postulated some risk scenarios for global energy prices and the implications for Alberta. The one they label as “most likely” states:

Global economic growth stabilizes; OPEC members unable to maintain current production levels indefinitely and prices start to rebound by summer or early fall. WTI = $US 50-60

- Some high-cost producers come off the market, including some OPEC members (e.g. Venezuela, Nigeria)

- Restocking continues and storage space for oil remains available (albeit near capacity).

- Prices continue to drop, but start to stabilize at $US 45 before rebounding above $US 55 in the summer, ultimately testing $US 60/bbl by year’s end.

- More oilsands projects in Alberta are delayed or scaled back, conventional drilling is reduced.

- Layoffs in Alberta’s energy sector and energy service providers, contractors, etc. continue.

- Alberta’s unemployment rate rises to 6.0 to 6.5 per cent by the end of 2015. • Provincial real GDP growth slows to around 0.5 to 1.0 per cent.

Alberta has certainly weathered bigger storms in the past and no doubt will do so again.