January 15, 2013 – Market Update

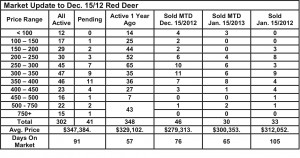

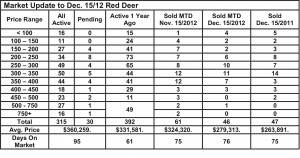

Tuesday, January 22nd, 2013January MLS sales in central Alberta are following last year’s trend. One difference is the number of pending sales in Red Deer at 41 which is significantly higher than it was last January 15th. Activity after the Christmas lull typically starts out slow in January and builds to a peak in April or May. That high pending sales count may be a sign that the strong spring market has come early.

The article below certainly explains why activity is already strong. Lots of people are moving to Alberta where there are more jobs and better wages. It’s difficult to predict how busy things will get, but if the world economy doesn’t get any worse and the US economy continues its gradual recovery, there will be lots of demand for our oil and natural gas. Strong demand for those commodities means stable prices which means continued exploration and drilling.

At the risk of being repetitive, a strong energy sector means a strong central Alberta economy and all the benefits that accrue from it. As mentioned below, new construction seems to be keeping pace, but there is the potential for some strain, which could lead to price inflation.

Accommodating the Alberta bound – by Will van’t Veld, Economist, ATB Financial

There’s a reason why Calgary’s C-Train has been feeling more congested lately: people have been flocking to Alberta. Not since the boom years have so many people arrived in our province—and if the pace keeps up it will have important implications for the local economy.

That people are coming to Alberta shouldn’t be a surprise. In fact, it’s slightly more surprising that it took until the first quarter of 2012 to see the numbers really spike. The unemployment rate is not only well below the national average, but wages have been steadily climbing. In fact, the average weekly wage in Alberta is now $156 higher than in Ontario.

While migrants from other provinces have recently shown more interest in our province, the upward trend in international migration has been occurring since the recession hit. Alberta gained about six thousand migrants due to international migration in the first quarter, almost double what the province was recording just five years ago.

The tremendous influx of people during the boom years caused a severe shortage of housing and other social services. So far, Alberta’s infrastructure and housing stock appears more prepared to accommodate the growing population. There’s a good reason for this, as housing starts, for instance, might have dipped during the past couple years, they didn’t fall off of a cliff either. Major infrastructure projects also continued to go ahead.

With companies actively recruiting out of province workers, both nationally and internationally, and the prosperity gap still heavily in Alberta’s favour, there’s a good chance more people will be Alberta bound in the coming quarters. At a certain point it may strain our ability to accommodate them, but so far so good.