MARKET UPDATE – November 15, 2016

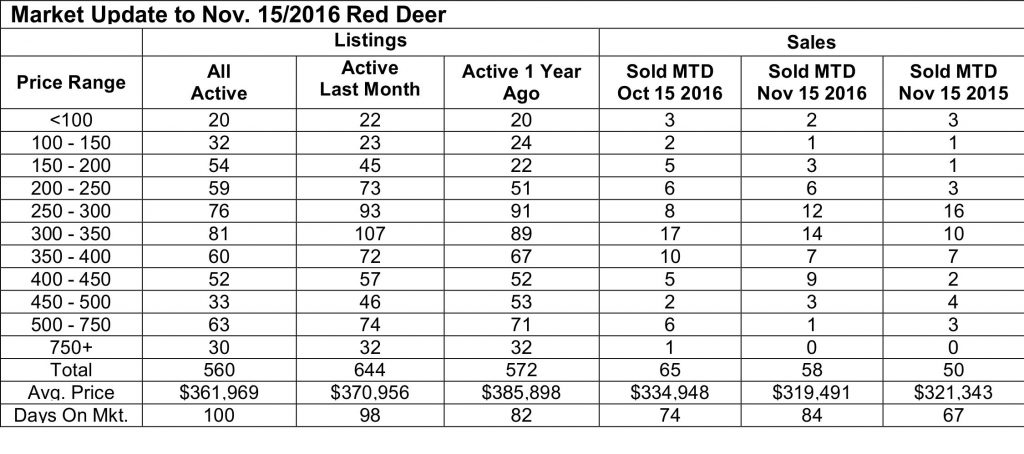

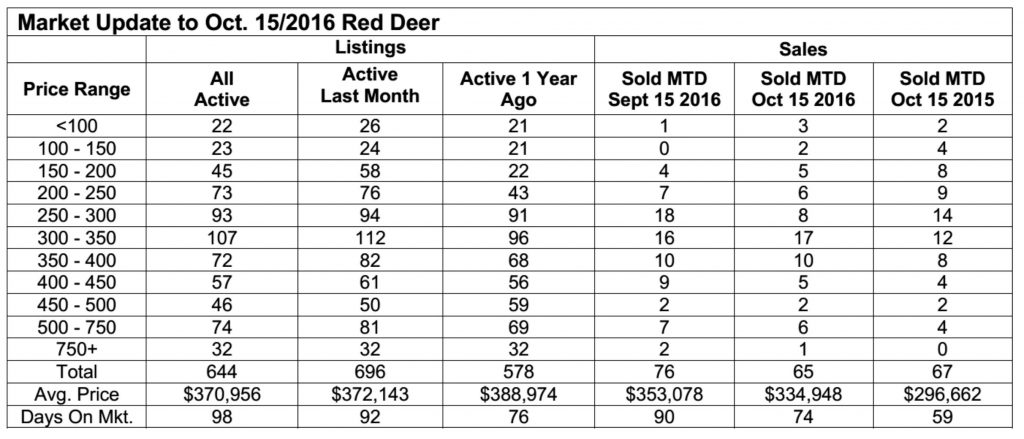

Monday, November 21st, 2016Strong sales in Red Deer in the first half of November compared to the same time last year continue to support our theory that we may be on the road to recovery. That theory is further supported by the lower number of active listings compared to last month. In a normal market we expect to see lower inventories as we move into winter, but high inventory levels are a symptom of a slower market, that we might expect in spite of the season, if the market was still in decline.

Anyone paying attention to the news will undoubtedly be wondering where our economy is heading. Oil prices briefly went over US$50 but are back down to the mid $45 range again. The future of oil prices will be decided by foreign oil producer’s (OPEC and Russia’s) ability to agree on lower production levels going forward. It is impossible to predict how that will play out, but common sense suggests that those countries are suffering the same as we are and production cuts are the answer.

The US election may provide some relief for Alberta as there is now optimism that the Keystone pipeline will be approved soon. That likelihood is putting pressure on our federal government to approve the Kinder Morgan expansion to Burnaby. So, there is some hope that we are now at the bottom of this economic slowdown. But, the recovery will be slower and it is likely that we will see similar real estate markets as we’ve experienced in 2016 well into 2017 at least. That is not the end of the world. Our local markets have fared reasonably well. Yes prices are off a little from their most recent highs reached in 2014, but are not down significantly except possibly at the high end of the price spectrum.

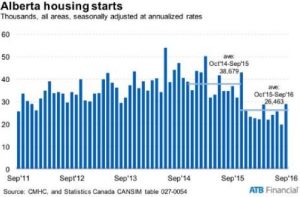

Recent Alberta Treasury Branch economic updates are reporting some good news in various sectors – vehicle sales in Alberta in September were up a little, manufacturing shipments from Alberta are only down 5% this year and were up a little in August and September, travelers to Alberta are experiencing lower accommodation prices which should encourage more travel here and the economic gain that accompanies that, the new home price index in Alberta is unchanged over the last two years, and there has been a lot of positive news about added activity in the energy sector.

We don’t believe there is a boom in our near future, although approval of two pipelines would give a tremendous boost to our confidence and the economy. Let’s hope common sense prevails on both sides of the border.