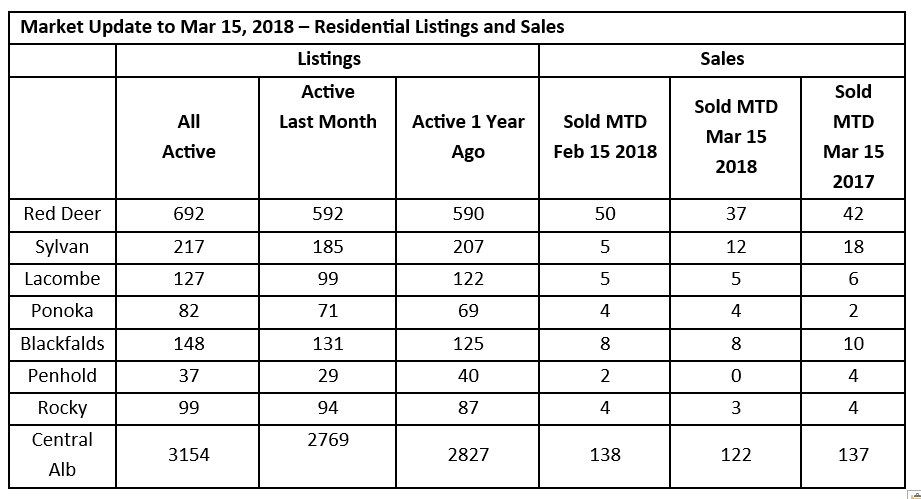

MARKET UPDATE – March 15, 2018

Friday, March 23rd, 2018Sales in the first two weeks in March were down compared to the first two weeks of February in every market except Sylvan lake. Sales were also down slightly compared to the first two weeks of February 2017 in most markets.

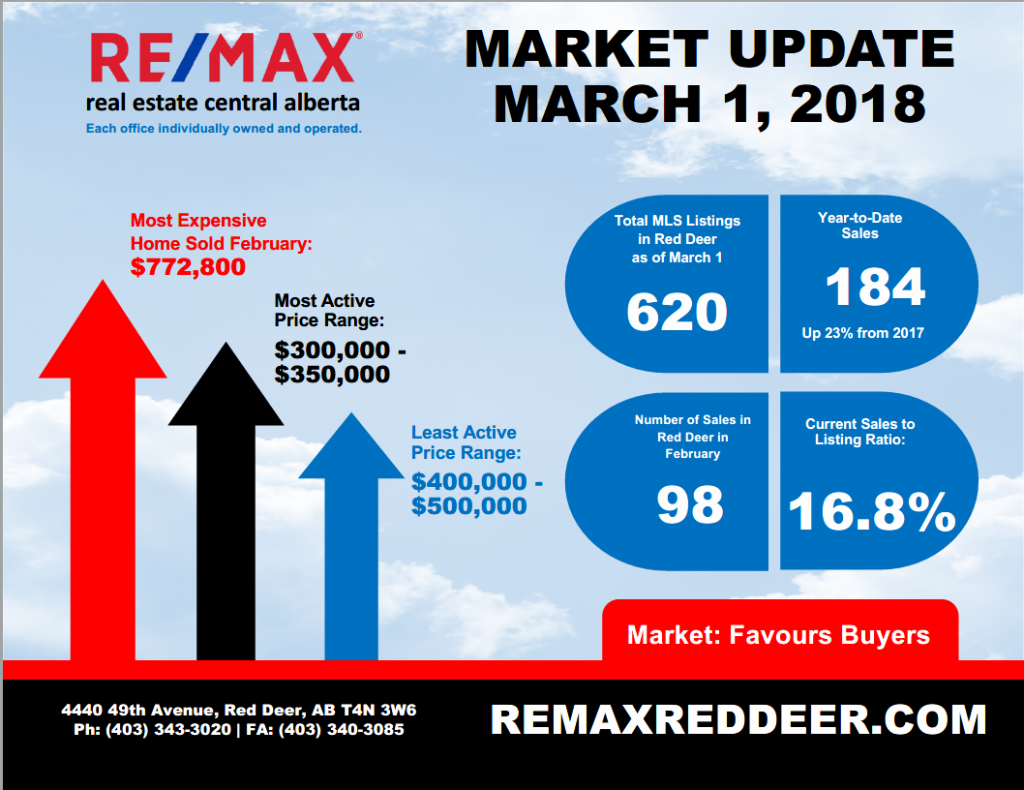

The number of active listings are up substantially in every market compared to last month and are also higher than last year at this time. We attribute some of the extra listing activity to consumer confidence that the economy has turned and their desire to move after 3 years of slower markets.

It does seem busier although that hasn’t translated to hard sales yet. A resolution to the conflict between Alberta and B.C. over the pipeline would go a long way to improving consumer confidence and market activity.