May 24, 2012 – Weekly Market Report

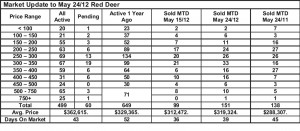

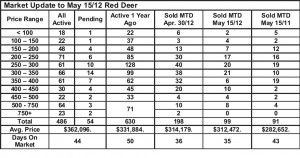

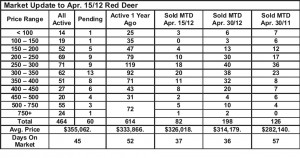

Wednesday, May 30th, 2012The market is slightly ahead of last year at this time in terms of sales, but with 150 fewer listings. That means firming prices and more competition for the well priced and well presented properties.

Activity at the higher end of the price spectrum is much improved, but don`t expect prices to move as quickly there since the ratio of demand to supply is still in buyer`s market territory.

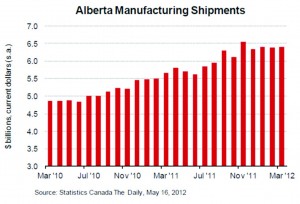

The amazing news in the article below is the fact that almost 80,000 new jobs have been created in Alberta in the past year.

While that definitely means lower unemployment rates in Alberta, it also means population growth. People in less fortunate parts of the country will move to the jobs and the very low rental vacancy rate here would support that idea. The great part is, as they get settled, many of them will move from their temporary rental accommodations into home purchases.

E.I. Numbers Down – Todd Hirsch, ATB Financial

In another sign of better economic times in Alberta, the social safety net for the unemployed has gotten a little bit less crowded.

The number of Albertans collecting employment insurance (E.I.) benefits fell to 26,900 in March. That number is adjusted to account for seasonality and it’s 31 per cent lower than it was in the same month a year ago. Nationally, total E.I. beneficiaries dropped to 549,410 in March—down by a much more modest 9.3 per cent from a year ago.

One factor that lowers the total number of beneficiaries is time. Benefits expire after a certain number of weeks. And in a region like Alberta where the unemployment rate is low, the number of eligible weeks is correspondingly low, with some unemployed workers eligible for as little as 14 weeks of benefits (depending on how long they had been working prior to a layoff).

However, in Alberta the most significant driver of E.I.’s falling number is job creation. As we know from recent labour force surveys, job creation in Alberta has been on the rise with nearly 80,000 new positions cropping up over the past year.

The release of the employment insurance report comes on an interesting day. This morning the federal government is expected to announce changes to the program which could tighten some of the conditions for collecting E.I. benefits. That may result in falling numbers in the months ahead—with or without new job creation.