September 30, 2011 – Weekly Market Update

Thursday, September 29th, 2011There Is Good News in Alberta – people are moving here in numbers not seen since 2006 and the reasons are pointed out below. Low unemployment, higher wages, and relatively affordable house prices are all strong motivators to entice people to move here.

Population growth is a huge contributing factor to economic stability in Alberta. It creates jobs and supports the housing industry. It provides workers to replace the huge number of baby boomers getting set to retire in the next few years and since most of those moving here are young, it creates new households and natural growth through childbirth. We welcome all those who are considering making Alberta home.

Canadians Still Looking Towards Alberta – Dan Sumner, Economist, ATB Financial

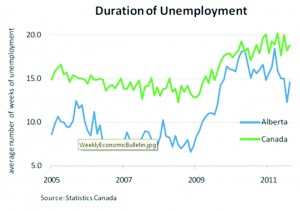

With talk of labour shortages returning to Alberta, population growth and migration are important variables for the provincial economy. And according to second quarter 2011 figures, Alberta continues to gain citizens from other Canadian provinces.

A total of 4,720 Canadians relocated to Alberta during the second quarter of 2011, largely unchanged from the 5,275 that moved here during Q1. Alberta is on pace for roughly +20,000 net-interprovincial migrants in 2011, which if achieved will be the highest annual pace for net interprovincial migration since 2006.

During Q2 Alberta continued to have the largest net migration gain from Ontario, while losing the largest number of net migrants to Saskatchewan. Alberta was by far the largest benefactor of net-interprovincial migration in Canada in Q2, with the province in second place (Saskatchewan) gaining only 1,239 net migrants.

Interprovincial migration can be a difficult variable to predict; however, with the unemployment rate lower in Alberta, wages higher, housing prices relatively affordable and the provincial economy expected to grow among the fastest in the country, it’s hard to imagine that more Canadians won’t be calling Alberta home over the near future.

While more skilled workers is essential for the continued development of Alberta’s economy, it also puts pressure on social and institutional resources. As a former premier of this province once stated, “when people move to Alberta, they don’t bring their schools and hospitals with them.”