January 20, 2016- Market Update

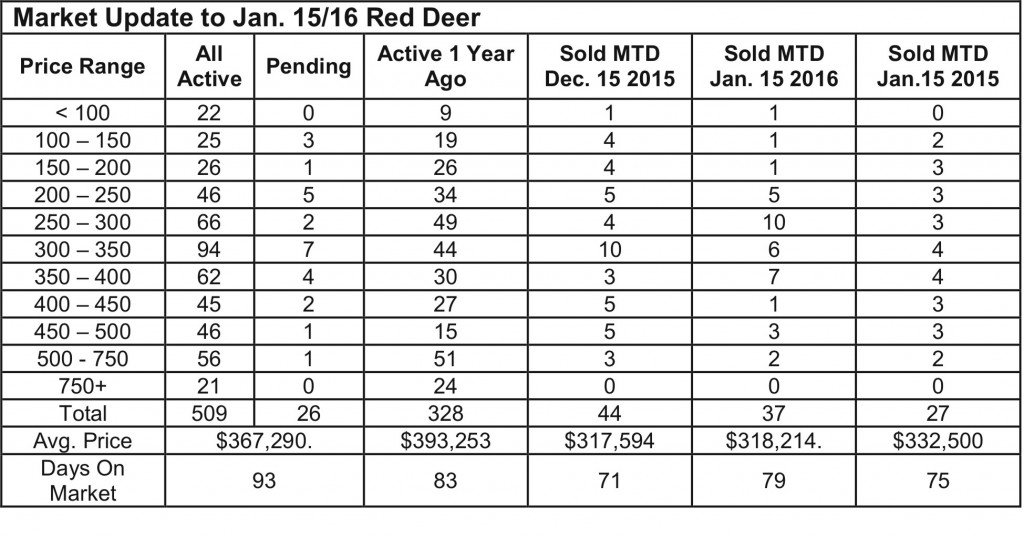

Wednesday, January 20th, 2016Market Update– Red Deer sales maintained a good pace starting out the new year, actually a little higher than the same period in 2014. The pending sales count indicates that we could finish up the month as almost strong as last year too. The number of active listings is considerably higher than it was last January and is a bit of a concern. An over-supply puts downward pressure on prices.

A bigger concern is that consumer confidence may be hurt by the constant barrage of tales of doom from the media – thousands of jobs lost in the energy industry etc. Truth is, many of the jobs lost in Alberta were in Fort McMurray and it’s likely a lot of those people were commuting to work from all over Canada. Their paychecks went home with them and the only contribution they made to the Alberta economy was the work they produced. We used to hear that there were 70,000 jobs unfilled in Alberta. Even if a lot of those jobs were energy related, some of them weren’t and have been undoubtedly filled as a result of the slack in the energy industry. While we are cognizant of the fact that people in central Alberta have lost jobs and potentially more could, we also believe that the media is only focused on the negative and that there is much positive out there if we just look for it. The Alberta Treasury Branch’s Alberta Economic Outlook for the first quarter of 2016 offers a realistic look at what we may experience over the next 18 months. If offers hope that things will slowly begin to turn around in the middle of this year and slowly get better from there. The summary of the report is as follows:

Downturns are not unusual in Alberta’s economy, which remains closely tied to the price of energy resources. A steep drop in oil prices in 2014 – which continued and accelerated in 2015 – led to a contraction in Alberta’s GDP of about one percent last year. Unfortunately, early 2016 holds little promise of a quick rebound. Excess global supply form OPEC producers, coupled with uncertainty in China, Europe and the Middle East, continues to weigh on oil prices. This has led to even greater stress on the balance sheets of the province’s energy producers as they struggle to reduce costs. Natural gas prices continue mostly unchanged in a price range unsupportive of new investment or production.

The strains in the oil patch are also weighing down industries peripheral to petroleum extraction, particularly manufacturing and construction. As well, weaker consumer sentiment has resulted in reduced retail trade and residential housing construction. All of this has resulted in an overall deterioration in the job market.

As always, though, there remain pockets of optimism. Agriculture, forestry, tourism – which are the province’s other major industries – continue to perform well. Prospects for 2016 are positive, particularly with the weak Canadian dollar making commodity exports more attractive, and encouraging more U.S. tourism.

The Economics and Research team at ATB Financial is estimating a GDP contraction of 1 percent in 2015, with a smaller contraction 0.5 percent in 2016. Most of the economic stress on the economy and labour market are expected in the first half of the year. Stability and even some return to modest growth is still anticipated by the end of the year.