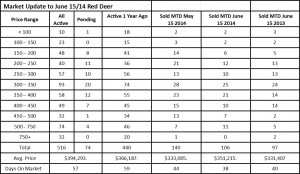

June 15 2014 – Market Update

Friday, June 20th, 2014Sales in the first two weeks of June couldn’t keep up with the blistering pace set in the first two weeks of May, but that is typical since the market typically slows a little going into June. The good news for buyers is that the number of active listings is back where it should be to keep a fairly balanced market.

Population growth is the driver responsible for a tight housing market and that is not likely to change based on what’s happening in the rest of the world. Unrest in the middle east and the ongoing problems between Russia and the Ukraine is driving oil prices higher which will encourage more activity in the Alberta energy sector and help keep all this activity going.

Alberta Population Growth Fastest in Canada – byTodd Hirsch, Chief Economist, ATB Financial

Alberta’s population continues to grow at a rate far faster than the national average. According to new estimates released this morning by Statistics Canada, the province’s population on the first day of April this year was 4,111,509. Canada’s total population was 35,427,524.

Over the last year, Alberta’s population increased by 3.25 per cent—nearly triple the national average (+1.1 per cent) and almost double that of the second-fastest growing province, Saskatchewan. British Columbia and Manitoba come in third and fourth, respectively, making the western provinces the four fastest growing populations in the country.

Three of the Atlantic provinces lost population, and Ontario and Quebec continue to grow at less than 1.0 per cent annually. The east-west split in population trends—and particularly the strong growth in Alberta—is being driven entirely by economics. Western Canada has a much better labour market which is luring interprovincial migrants who want work. With the lowest unemployment rates in the country, Saskatchewan (3.7 per cent) and Alberta (4.6 per cent) are the places to be if you’re looking for work.

In the first quarter of 2014 alone, Alberta gained over 24,000 people from other provinces (while about 15,000 moved out of Alberta). The net gain was 9,581, which puts the province on track for a total net gain of close to 40,000 interprovincial migrants this year.

Singing the Homebuyer Blues – by Nick Ford, Economist, ATB Financial

People looking to purchase an existing home in Calgary or Edmonton (or central Alberta) might be feeling irritated and discouraged. There isn’t a lot on the market these days and what is available is going up in price….

Demand for existing homes in Alberta is the result of growing employment numbers and the influx of people moving here to take those jobs. Unfortunately, fewer listings and increasing prices are realities homebuyers will have to endure. There is an upside: as prices rise, more people will be inclined to list, which will boost supply.