September 21, 2012 – Market Update

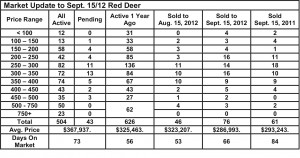

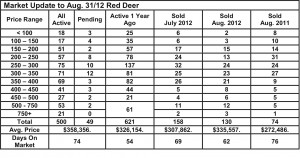

Friday, September 21st, 2012A recent news article suggested that home sales this summer have been impacted by the changes to mortgage rules, specifically lowering the maximum amortization from 30 years to 25. The article quoted the Finance Minister as saying he was no longer concerned about a housing bubble. Sales of starter homes in Red Deer were certainly slower in August and we suspected that the mortgage changes had impacted our market. But, it seems there is another pressure out there that may have an even stronger impact. Starter sales to date in September seem to have recovered likely because of the strong population growth discussed below which has created a heated rental market and the inflating rents that go with that.

The rental market is always the first to feel the pressure from population growth. Many people moving to Alberta have left unsold homes behind, or won’t buy a home until they are sure they want to stay, or can’t buy a home until they’ve been in their jobs for a while.

Tenants who have been here and renting for a while and experience the rent increases are the ones to react. As soon as rents equal or exceed mortgage payments, they become motivated to look at home ownership.

Our lives, our homes – Will Van’t Veld, ATB Economics

In the river of information on the residential housing market that flows by every day, there comes, once every five years, the big houseboat of data that makes for interesting watching.

It’s Canada’s Census.

Statistics Canada releases the census results in stages, and on Wednesday came data on families, households and marital status. Nationally, the number of private households increased by 7.1 per cent between the census periods, 2006-2011. And, yes, Alberta’s growth rate of 10.7 per cent was the fastest in the nation, corresponding to an annual average of 30,000 new households. That’s almost 16 per cent of the 189,000 new households added nationally.

Every new household needs a home and back in February, the agency released data on the size of the private housing stock. From that, we know that the housing stock increased on

average by 34,000 units in Alberta and by 199,000 nationally.

Clearly, construction between the latest periods was more than adequate to accommodate demographic demand, with the difference indicating that more families have second homes (there’s also likely more vacant homes out there). Housing is cyclical and some of the current strength likely compensates for under building in the previous decade, but clearly the cycle has been on the upswing for quite a while now.

Another interesting revelation from the data was how the structure of families is changing. There was a jump in growth of households of couples without children (up 12.8 per cent in Alberta) and people living alone (up 11 per cent), explaining the surge in preference for condos.