March 31, 2013 – Market Update

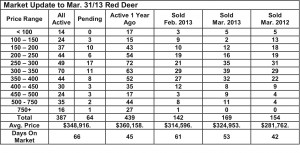

Friday, April 5th, 2013Listing inventories in Red Deer are up from last month, but down 12% from this time last year. At the same time, March sales are up slightly from February 2013 and up substantially from March 2012. The sales to listing ratio in Red Deer last month climbed even further into Seller’s market territory and we are now seeing evidence that prices are rising compared to last year. The activity in Red Deer reflects a strengthening market across all of central Alberta.

The scenario of increased listings, but lower inventories than last year, coupled with stronger sales, is happening in all central Alberta markets with Red Deer and Blackfalds leading the way. In the short term, we can expect to see slightly higher prices across central Alberta as buyers compete for the “good” homes, especially in the $200,000 – $400,000 price range.

We are constantly asked “Where is the real estate market heading?” Predictions are obviously dangerous, but the central Alberta real estate market still rises and falls with activity in the energy sector. If the Keystone pipeline is approved, we think we can expect the market to continue to strengthen. If not, it is likely we will find things a little slower until another solution is found to get our heavy oil to market. It is unquestionable that will eventually happen. Part of the answer may be explained below:

Oil patch rides the rails to price surge — The Globe and Mail

Price discounts on western Canada’s heavy oil have narrowed dramatically, as producers move record amounts of crude by rail in order to sidestep pipeline bottlenecks and reach thirsty U.S. refineries. The price spread between Western Canadian Select and the North American benchmark is at its narrowest in more than a year, after shrinking rapidly in the last month. WCS sold for about $78 (U.S.) a barrel late last week, about $15 a barrel less than West Texas intermediate oil. That differential had reached nearly $35 in January.

The shrinking spread gives a reprieve to energy companies producing heavy oil in western Canada.

Those companies, which include global giants and small producers, have been hammered by the steep discount, leaving some to trim their budgets and pull back on expansion plans. The reduced differential is also welcome news for the government of Alberta, which is facing its sixth deficit in a row due in part to the price gap weighing on royalty revenue.

In the first 12 weeks of 2013, the number of carloads of petroleum products shipped by U.S. and Canadian railways was up 47 per cent from its year-ago level, according to National Bank Financial’s chief economist and strategist Stéfane Marion.

“Rail pipelines,” he said in a research note Monday, “now account for more than 5 per cent of total rail traffic in Canada, a tenfold increase from just three years ago.” Analysts at Peters & Co. Ltd. project that crude oil transported by rail from Western Canada is expected to exceed 250,000 barrels a day by the end of 2013.

“The recent tightening in Canadian crude differentials is being assisted by the fact that material volumes are now being transported to market by rail,” the firm said Monday. “The use of rail is allowing for another outlet or market clearing mechanism other than pipeline.”

Meanwhile, railways are ramping up their crude capacity. “We see it as a sustainable, long-term growth market for our railroad,” said spokesman Ed Greenberg of Canadian Pacific Railway Ltd., noting that the company anticipates moving 70,000 carloads of crude by rail this year, up from 53,000 in 2012. Looking to 2016, CP plans to be moving two to three times its present volume of crude……

Energy companies themselves are showing signs of optimism and applauding railroads. “The options for transporting western Canadian crude oil are in the process of being expanded through pipeline alterations and expansions as well as with the rapidly expanding use of rail for transportation to refining and export points,” Whitecap Resources Inc. said in a press release last month….