March Real Estate Market News

We have been hearing plenty about the hot real estate market in Canada lately. It hasn’t arrived here yet because the energy sector that we are involved in locally is not fully back on its feet, but there are definitely signs that things will change over the next year.

First, Ft. McMurray is booming which is probably why the market in Calgary is getting better (head office city). The expected economic benefit for all of Alberta is massive.

Second, the world economy is slowing improving – the stock markets being the best barometer.

Third, there is a new oil boom happening in the foothills of Alberta in the 50 year old Pembina field. It seems the same shale recovery technology that has driven our gas prices down can be used to recover an additional 5 billion (or so) barrels of sweet light crude from shale formations right here in Alberta. A huge boon for our local drilling and service companies.

There is no question that Alberta will again some day be a world leader in every way. The fundamentals haven’t changed. We still have all that oil and gas.

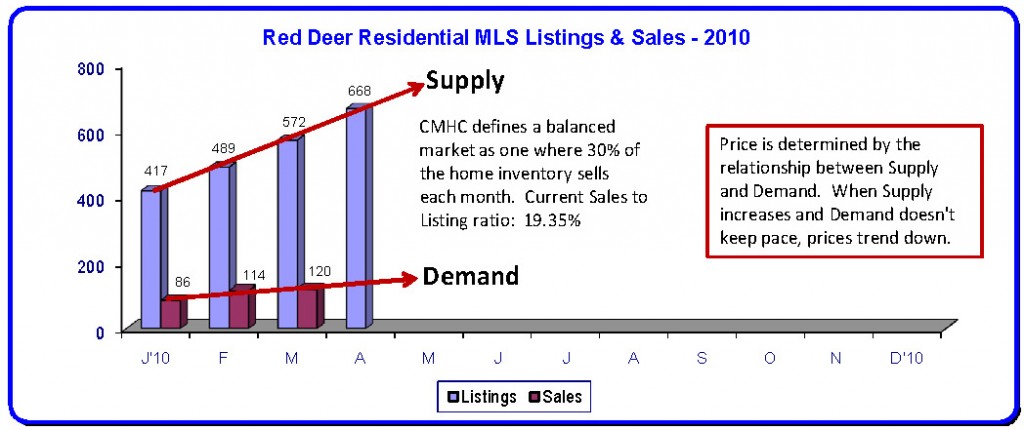

So, when will the market improve? I don’t believe we will experience a strong real estate market for at least a year. Why? Well, when some of those employed in the energy sector do get back to work, it will take a little time for them to catch up and feel comfortable enough to spend on the large ticket items.

The world economy is still fragile. The American economy is even more fragile and the US is still our largest trading partner. Our dollar is at par which makes American demand for our goods weaker. The US housing market is still in a shambles and billions of dollars that would normally get spent in our local markets are heading south to take advantage of those bargains.

Interest rates are rising. An interest rate increase is the same as a price increase, except it’s the banks profiting instead of homeowners.

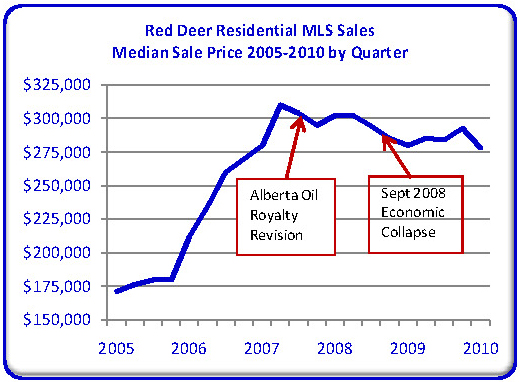

Our prices are off only about 10 – 15% from the peak in 2007. There isn’t a lot of room for inflation before houses become less unaffordable again.

The best housing market is one that is balanced, with inflation that matches the annual inflation rate, where there are enough homes to choose from and adequate buyers for the available inventory. And that’s what I’m hoping for in 2010.