Red Deer Market Update – Feb 4/11

| Market Update to Jan. 31/11 Red Deer | ||||||

| Price Range | All

Active |

Pending | Active 1 Year Ago | Sold MTD

Jan. 27/11 |

Sold MTD

Jan. 31/11 |

Sold MTD

Jan. 31/10 |

| < 100 | 23 | 0 | 20 | 2 | 3 | 6 |

| 100 – 150 | 39 | 3 | 28 | 2 | 4 | 3 |

| 150 – 200 | 51 | 3 | 44 | 6 | 8 | 5 |

| 200 – 250 | 64 | 5 | 71 | 14 | 14 | 15 |

| 250 – 300 | 94 | 10 | 79 | 22 | 27 | 20 |

| 300 – 325 | 47 | 3 | 44 | 5 | 6 | 18 |

| 325 – 350 | 33 | 2 | 38 | 5 | 5 | 11 |

| 350 – 375 | 22 | 2 | 25 | 9 | 9 | 2 |

| 375 – 400 | 26 | 1 | 39 | 5 | 5 | 0 |

| 400 – 450 | 43 | 2 | 31 | 5 | 6 | 1 |

| 450 – 500 | 15 | 0 | 24 | 2 | 3 | 1 |

| 500+ | 52 | 1 | 51 | 1 | 1 | 3 |

| Total | 509 | 32 | 494 | 78 | 91 | 85 |

| Avg. Price | $317,037. | $323,250. | $287,716. | $285,785. | $276,381. | |

| Days On Market | 60 | 53 | 66 | 64 | 57 | |

Alberta Housing is Moderately Affordable! ATB Financial – Jan 28, 2011

According to the 7th annual Demographia International Housing Affordability Survey, Edmonton is the country’s most affordable large city, followed closely by Ottawa and Calgary. This pronouncement might turn some heads, but the rebound in the housing market was actually stronger in Canada’s other major centres – especially in Toronto and Vancouver. Average housing prices in Montreal might be lower, but so is average household income.

The survey compared the ratio of median family income to average housing price for cities in the English speaking world. This measure is different from other surveys which take interest rates into account and look at the monthly percentage of income used to service a typical mortgage.

The authors wanted to focus on home values instead of monthly outlays, as over the life a mortgage interest rates can change considerably but the price paid for the house stays constant.

Edmonton and Calgary recorded ratios of 3.5 and 4.0, which are both substantially below Vancouver, where the typical home is 9.5 times the household income. A ratio of under three was considered affordable, which was the historic average.

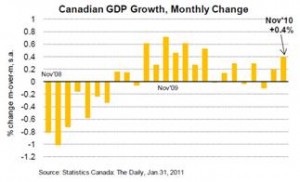

Strong GDP Growth in November – Todd Hirsch – Senior Economist, ATB Financial

While economic expansion in Canada got off to a good start at the beginning of 2010, growth petered out through the summer and early fall. But new data this morning suggest growth started to ramp back up toward the end of the year.

The total value of all goods and services produced in the Canadian economy in November expanded by 0.4% month-over-month, the highest rate of increase since March of last year, and twice the increase posted in October. That surprised economists, who had been forecasting a gain of only 0.3%, which still would have been respectably strong growth.

The monthly GDP data are compiled only at the national level. However, one of the strongest components of growth in November was oil and gas extraction (+2.4%). Although not exclusively an Alberta industry, strong growth in energy bodes well for this province.

Other national sectors that did well in November include wholesale (+1.5%) and retail trade (+1.4%), both of which suggest Canadian consumers are feeling increasingly confident. Monthly losses were posted in manufacturing (-0.8%) and construction (-0.4%).

The stronger-than-expected growth in November should lift overall fourth quarter growth to the range of 2.0-2.5%. That’s still in line with the 2.4% projection by the Bank of Canada for all of 2011. Therefore, today’s positive GDP report is unlikely to prompt the Bank of Canada to raise rates sooner.