Red Deer Market Update – Feb 18/11

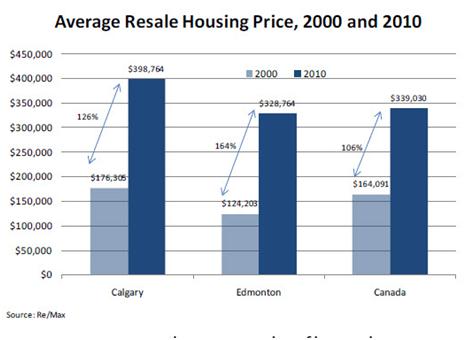

RE/MAX re-leased a report this week on Canada’s major residential real estate markets and how they’ve per-formed over the past decade. With the average price of houses increasing between 126% and 164% in both of Alberta’s major cities, it almost goes without saying that investing in your home was an extraordinarily good investment over the past ten years.

The report sees both of Alberta’s major cities creeping into a sellers’ market in 2011 (i.e. sales occurring faster than new listings). But despite the pick-up in sales activity prices aren’t expected to deviate far from the cur-rent average. The report also noted there could be a bit of a surge in activity as homebuyers attempt to qualify for mortgages before the new mortgage insurance rules are adopted.

With mortgage rates headed higher and Alberta’s wage growth rate set to decline, affordability will certainly be more of an issue over the next decade. The past ten years saw the provincial average weekly wage index increase by slightly over 50% and the average mortgage rate drop by over 2 percentage points. Although wages are not expected to fall back much, rates are heading higher and this will reverse some of these affordability trends and limit upside potential to the housing market.

We believe that the central Alberta market will mirror Edmonton and Calgary’s markets although the timing could vary slightly.

And the investment value of real estate in central Alberta has certainly been very similar to that identified in Calgary and Edmonton.