August 26, 2011 – Weekly Market Update

Is Your Glass Half Empty or Half Full? We are bombarded daily with bad news from all over the world. Consumer confidence is directly impacted by that media. Consumers make lifestyle decisions based on how they feel.

There is always good news and positive events going on in our world, especially in Canada and Alberta. We are truly blessed to live here and benefit from the rich resources we own just because we live here. If we look for the good news and try to look at the glass as half full, our lives will be more happy and fulfilled than those that choose the other option.

Prices Down In July, by Todd Hirsch, Senior Economist, Alberta Treasury Branches

Even small bits of good economic news are welcomed these days, and that news was delivered by Statistics Canada’s report on the Consumer Price Index this morning.

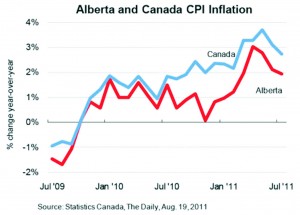

Prices for typical consumers rose by 2.7% year-over-year in July, down from the 3.1% annualized advance in June, and 3.7% in May. The national CPI increased in June primarily because of higher prices for gasoline and food purchased from stores.

In Alberta, annual consumer price inflation also eased up a bit, falling to a year-over-year increase of 1.9%. Many of the factors that drove prices higher nationally were present in Alberta as well. Energy prices rose 14.1%, and gasoline jumped by 23.0%. Food prices also rose, especially fresh vegetables (+7.7%) and meat (+6.5%).

Helping keep overall inflation in Alberta in check were price decreases for women’s clothing (-9.0%), footwear (-5.2%), and purchasing and leasing of new motor vehicles (-2.7%).

The softer inflation figures nationally will certainly support the Bank of Canada’s likely decision to keep interest rates where they’re at for an extended period of time. With all of the other more troubling economic headwinds hitting the Canadian economy from the US and Europe (see Economically Speaking), the Bank of Canada must be viewing the tame inflation figures with some sigh of relief.

On the other hand, the fact that inflation appears to be ebbing in Canada could also be considered one more piece of bad economic news. It does suggest that consumer sentiment is perhaps waning a bit, prompting shoppers to hold back on purchases and forcing retailers to slash prices. For every glass that is half full, the other half is still empty!