September 2011 – Monthly Market Update

A fragile world economy isn’t having a big an effect in central Alberta yet. Our market cautiously continues in positive territory with year to date sales ahead of 2010. Central Alberta Realtor’s Association statistics show year to date sales across the region up 18.1% over the same period last year and every local market we track is up except Sylvan Lake which is down very slightly (3.8%).

There is no question that shale oil activity along the eastern slopes of the Rocky Mountains and development in the oil sands are the two driving factors. It appears that the US government is close to approving a pipeline to move large amounts of oil from Ft. McMurray to Texas. Increased activity in the oil sands is also helping our natural gas industry because separating the oil from the sand requires large amounts of natural gas.

The other direct benefit of the shaky world economic situation to our housing market is low interest rates. Low rates will stay around as long as the economic growth of our trading partners is slow. It is difficult for the Bank of Canada to raise our rates when other countries are forced to keep theirs low to stimulate economic growth. Raising our interest rates would increase the value of the Canadian dollar which is already trading higher against the US dollar than it should be to keep our exports affordable.

It is a great time to buy a home. The overall market still favours buyers in many ways – there are lots of homes to choose from, prices are still low compared to the 2006 and 2007 boom market and record low interest rates continue to make home ownership affordable.

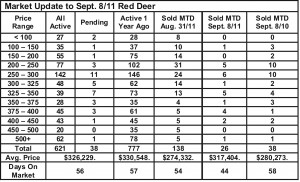

Red Deer – year to date sales are up 13.1% over the same period in 2010 – demand is up. The number of active listings at the beginning of September are down 20% this year compared to last – supply is down. The sales to listing ratio in August was 22%, almost in the 25 – 30% range that represents a balanced market – the market balance slightly favours buyers.

Lacombe – year to date sales are up 8.2% compared to last year – demand is up. The number of active listings at the beginning of September is just slightly higher than last September – supply is equal. The sales to listings ratio in August of this year was 18.5%, up slightly from July – the market favours buyers.

Ponoka – year to date sales are still up 24% over the same period in 2010 – demand is up. Active listings are 19% higher than Sept., 2010 – supply is up. The sales to listings ratio in August was 13.5%, a 2% improvement over July – the market still favours buyers.

Sylvan Lake – year to date sales are down 3.8% over the same period in 2010 – demand is down slightly. Active listings in September were the same as September, 2010 – supply is even. The sales to listings ratio in August was 8% – the market heavily favours buyers.

Blackfalds – year to date sales are up 25.5% compared to the same period in 2010 – demand is up. Active listings on Aug. 1 were equal compared to September 2010 – supply is equal. The sales to listings ratio in August was 19.3% compared to 13.6% in July of this year – the market still favours buyers but is showing strong gains back to balance.

The relationship between supply and demand in the acreage market continues to heavily favour buyers, but August sales activity was promising with 10 acreage sales in central Alberta over $500,000.