October 21, 2011 – Weekly Market Update

There’s always good news out there if you are willing to look for it, especially in Alberta these days. In the last few years we’ve become adept at wondering when the other shoe is going to drop. The media’s current fixation on issues in the US and Europe have some folks wondering when the next bad news will hit.

There’s always good news out there if you are willing to look for it, especially in Alberta these days. In the last few years we’ve become adept at wondering when the other shoe is going to drop. The media’s current fixation on issues in the US and Europe have some folks wondering when the next bad news will hit.

As everyone in central Alberta knows, the strength of our economy is highly reliant on the price of oil and gas. There has been some speculation that oil and gas prices are bound to soften as the world economy slows. A recent article in the Globe and Mail suggests that oil consumption in China is still growing and quotes the oil analysts at Barclays Capital in London who said “There is a large supply deficit in the global oil market, with demand exceeding supply in the third quarter”.

That suggests to us that there is a long term future for Alberta’s oil and gas and the jobs and healthy economy that come with it.

Manufacturing Shipments Perk-up in August – by Dan Sumner, Economist – ATB Financial

When Canadians think of manufacturing, they typically think of Central Canada. But Alberta’s manufacturing sector has grown in leaps and bounds over the past ten years and more recently has been an important driver behind the post-recession recovery.

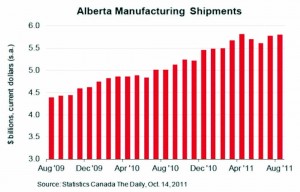

Alberta manufacturers managed to grow their shipments 0.4% in August to $5.79 billion. Compared to August of last year, shipments are higher by 15.6%, the second largest year-over-year gain of any province (Saskatchewan has seen the largest at 17.1%).

While shipments were up marginally in August, they have been essentially flat for the last five months (see graph). However, this flatness comes on the heels of nearly straight gains from the middle of 2009 to Q1 of this year. Alberta’s manufacturing sector has also been an important job creation machine recently, adding more jobs than any other sector over the past twelve months.

Nationally the manufacturing story was quite positive in August, with shipments advancing by a higher than expected 1.4%. Canadian shipments have risen two months in a row now, partly a result of the unwinding of effects (supply chain disruptions) associated with the earthquake and tsunami in Japan.

This morning’s national release adds to the evidence that Canadian GDP growth will be positive in Q3, allowing Canada to avoid a technical recession (defined as two consecutive quarters of negative GDP growth).

With a healthy energy sector and rising oil sands production, manufacturing in Alberta should continue to grow in the long run. But in the near-term, shipments from this province will continue to be subject to swings in gasoline and oil product prices.