December 9, 2011 – Weekly Market Update

Market Update

Lacombe – Year to date sales are up 7.4% over the same period last year. Listings are also slightly higher as well and the ratio of sales to active listings is currently 17% representing a market where the buyer has the advantage.

Ponoka – Year to date sales are up 34.6% over the same period in 2010. Active listings are about the same as they were a year ago. The sales to active listings ratio is 21% which still represents a buyer’s market but is rapidly approaching balance.

Blackfalds – Year to date sales are up 27.7% over the same period last year. Active listings at Dec. 1, 2011 are down slightly from Dec. 2010. The December sales to active listings ratio was 11.2% – still a buyer’s market.

Sylvan Lake – Year to date sales are up 1.9% over the same period last year. Active listings as of Dec. 1, 2011 are slightly lower than the same time in 2010 and the sales to active listing ratio at 8.3% suggests the Sylvan Lake market still heavily favours buyers.

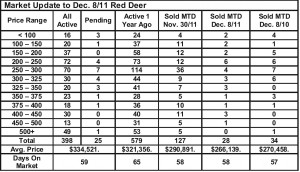

Red Deer – Year to date sales are up 15% over the same period last year. Active listings as of Dec 1 this year are down a whopping 53% over Dec. 1, 2010. December sales to active listing ratio was 30% – well into balanced market territory and closing in on a seller’s market.

Central Alberta – Year to date sales are up 20.5% over the same period last year. Active listings as of Dec. 1 this year are down very slightly from Dec. 2010. December sales to active listing ratio was 8.75% – overall, still a market where the buyer has the advantage.

Summary – There are definite signs that the real estate market in central Alberta is coming out of the doldrums we’ve been experiencing for the last 3 years. Red Deer is the first to reach balanced market conditions, but if economic conditions remain constant over the next few months, the rest of our markets will soon catch up and even trend toward seller’s market territory, where the sales to active listings ratio is higher than 30%. That means just 3 houses available for every buyer instead of the 10 or more we’ve experienced since 2008.

The reasons for our improving market are quite simple. Oil prices continue to hover around $100 and drilling activity is up 41% over last year. Alberta’s economy is once again leading the provinces with 3% GDP growth this year. A strong economy generates jobs and jobs entice people to move to Alberta. More than 25,000 people migrated to Alberta from other countries in 2010 and interprovincial migration is back in positive territory (forecasted at 10,000 for 2011).

Population growth creates demand for housing. The first indication of strengthening comes in the rental market since many of those folks moving here are not in a position to buy homes. The vacancy rate in Red Deer is now estimated to be about 1%.

There are caveats on this forecast. 87.5% of Alberta’s exports go to the U.S. Our fortunes are tied tightly to the U.S. economy. We are hearing encouraging reports from south of the border, but the improvement is slow and gradual which will temper our growth. We are predicting balanced market conditions for 2012 in central Alberta but don’t expect much in the way of price inflation.