February 15, 2012 – Market Report

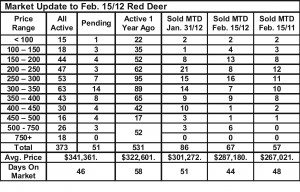

Optimism continues for the Alberta economy and the central Alberta housing market. Year to date sales in central Alberta are up just over 8% compared to the same time last year while listing inventories are down. The number of pending sales is up substantially which suggests that February sales will be much stronger than a year ago.

The improvement in the market is as always a result of high oil prices and low interest rates. As long as we have that combination, the market will continue to strengthen and buyers can expect less choice and higher prices

CMHC Housing Outlook – 1st Quarter 2012 – In Alberta, single-detached starts moved lower in 2011 due to rising inventories and heightened supply in the new and resale markets. Moving forward, demand is expected to improve with continued economic growth and job creation. In 2012, single-detached starts are projected to rise by 14 per cent to 17,300 units. In 2013, price gains and modestly higher mortgage rates will increase monthly carrying costs. Builders will thus align new construction to presales to keep inventory low. This will moderate the gain to single-detached starts next year to four per cent.

Multi-family starts in Alberta will continue to rise over the forecast period. Production in 2012 is projected to increase by about 12 per cent over 2011 activity to 11,800 units, and then level at 12,000 units in 2013. This is about double the recent low of nearly 6,000 units in 2009, yet substantially below the high of approximately 20,200 units in 2007. After a period of dormancy, the high-rise condominium market is beginning to show more signs of activity, and this market should improve with lower inventories and the expected economic and demographic growth.

Residential MLS® sales in Alberta rose around seven per cent in 2011, while new listings decreased by four per cent. Alberta’s bright economic and demographic outlook will result in growing demand for resale homes. In 2012, resale transactions are projected to rise to 54,650 units and then increase by over three per cent to 56,550 in 2013.

Most of Alberta’s major resale markets were in buyers’ market conditions through 2011, holding price growth to near one per cent. The notable exception was the stronger market conditions in Wood Buffalo, where the oil sands driven economy boosted the average price by 6.5 per cent. Over the forecast period, gains in employment and migration are expected to lift demand, improve market balance, and increase Alberta’s average resale price to $363,650 in 2012 and then rise to $372,300 in 2013.

Alberta CMHC summary:

- Housing starts will rise by 13 per cent to 29,100 units in 2012 and increase to 30,000 units in 2013.

- MLS® sales will rise by over two per cent to 54,650 in 2012 with a further gain in 2013 to 56,550.

- The average resale price will rise by over two per cent to about $363,700 in 2012 followed by similar gain to $372,300 in 2013.