Mar. 31, 2012 – Central Alberta Market Update

The central Alberta housing market is healthy and showing signs of further improvement as the world and U.S. economies continue to strengthen. Very simply, oil prices dictate our future. Strong demand for oil keeps prices high and drives demand for the shale oil along the foothills and the oil sands.

The provincial government is predicting $5 billion surpluses by 2015 for a province that already has the lowest taxes, best health care system and no debt. People from other provinces are once again coming to Alberta in large numbers and they all need places to live, which explains our suddenly low vacancy rates and rising rents.

The future certainly seems bright for now – there is still good availability of homes, house prices are affordable, interest rates are low. We expect the current trend to continue for the short term, but expect that all markets will swing into seller’s territory in the next few months and house prices will slowly rise in response stronger demand and lower supply.

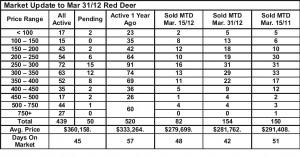

Red Deer – Listing inventories are down from a year ago, but up from a month ago. Sales in March were up very slightly over March 2011 and year to date sales are up 9.3% over last year. The current listing to sales ratio is well into seller`s market territory at just under 38%. That means 4 out of 10 homes listed in Red Deer sold last month.

The Red Deer market is typically the first to experience increases in sales, but the other central Alberta markets are sure to follow suit as good product becomes more scarce and more expensive in Red Deer. Very tight vacancy rates for Red Deer rentals is certainly contributing to the increase in sales this year.

Lacombe – Lacombe year to date sales are up more than 30% over the same period in 2011, but inventories are more than adequate at this point to handle the demand. Only slightly more than 1 in 10 houses for sale in Lacombe sold in March, which points to stable prices until that ratio changes. Inventories are slightly higher than this time last year making Lacombe a good option for buyers.

Sylvan Lake – year to date sales are also up more than 30% but inventory levels equal to last year are keeping the sales to listing ratio at 1 in 10 homes sold in March. The number of properties for sale in Sylvan Lake is skewed a little by the inclusion of recreation and lake properties, but there is still a good supply of homes available in all markets. Sylvan Lake also represents good opportunities for home buyers.

Ponoka – affordability has been a key factor in the Ponoka market and buyers are coming to play with year to date sales more than double the same period as last year. Listing inventories are shrinking slightly and two out of ten homes for sale sold last month. Good starter product in Ponoka is getting scarce and that market is tightening up at the low end of the price spectrum. We expect to see prices starting to catch up with the rest of the central Alberta market.

Blackfalds – this market is most closely following the Red Deer market with more than 3 out of 10 homes selling in March. Inventory levels are quite low and year to date sales are up 35% over 2011. Starter inventory is still plentiful but could soon shrink as people who can’t find what they are looking for in Red Deer start to look outside the city at the closest point available.