Central Alberta Market Report – April 30, 2012

Market Update – The central Alberta real estate market continues to strengthen as we move through the spring market. Generally, the supply of homes for sale in central Alberta is shrinking or stable while demand continues to grow. Most of the smaller markets are in balance or favor buyers, while the Red Deer market is clearly in seller’s market territory with a 44% sales to listing ratio in April. That means more competition for the good Red Deer properties and the potential for price increases. Typically, the Red Deer market will improve first with the smaller surrounding centres following suit. As prices in Red Deer firm up, more buyers will consider the smaller centres and the comparably lower prices available there.

Obviously, oil continues to be the stimulus for economic activity in central Alberta. High oil prices make horizontal drilling in the rock formations along the foothills viable. Those wells require huge frac activity to free up the oil and central Alberta is a centre for frac companies.

The dark clouds on the horizon remain very low natural gas prices, the perceived “over-heated” Canadian real estate market, the US economic recovery and the European economic crisis. The Governor of the Bank of Canada concerned enough about real estate inflation in Toronto that he is considering an interest rate increase for all of Canada. In spite of the negatives, the short term future for Alberta appears to be very bright. Our provincial government seems to believe so too, planning on huge spending programs and counting on massive resource revenues to pay the bills. Those huge spending programs will almost certainly fuel strong growth for the short term as long as the expected revenues materialize to fund them.

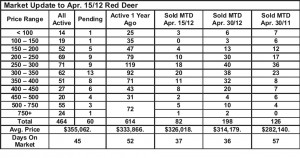

Red Deer – year to date sales are up 22% over 2011. April sales are up 57% over April 2011. Listings as of May 1 are down 24% from May 1, 2011. April sales to listing ratio – 43.9% – Seller’s Market.

Lacombe – year to date sales are up 34% over 2011. April sales are up 39% over April 2011. Listings as of May 1 are at the same level as May 1, 2011. April sales to listing ratio – 20% – Buyer’s Market

Sylvan Lake – year to date sales are up 40% over 2011. April sales are up 35% over April 2011. Listings as of May 1 are at the same level as May 1, 2011. April sales to listing ratio – 15.25% – Buyer’s Market

Ponoka – year to date sales are up 70% over 2011. April sales were slightly lower than April 2011. Listings as of May 1 are slightly higher than at May 1, 2011. April sales to listing ratio – 9.25% – Buyer’s Market

Blackfalds – year to date sales are up 54% over 2011. April sales are up 130% over April 2011. Listings as of May 1 are down 24% compared to May 1, 2011. April sales to listing ratio – 31.5% – Seller’s Market

Blackfalds being the closest market to Red Deer, is now benefitting from the tightening supply and stronger prices in Red Deer. Assuming the current trends continue, the rest of our smaller markets will soon follow suit.

One other interesting fact about the central Alberta real estate market in 2012 is that demand for homes above the starter market is much stronger than we’ve experienced since 2007. Renewed confidence in the economy seems to have people moving up once again.