May 18, 2012 – Market Update

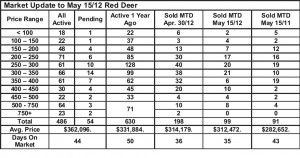

Market Update – Alberta’s economy is still steaming ahead, but maybe not with the same strength as in 2005 – 2007. That is good news. Uncontrolled growth takes a heavy toll on everyone and isn’t healthy. While we all want the value of our largest asset (our homes) to increase, flat out inflation makes it difficult for first time buyers to enter the market. First time buyers make it possible for the people selling those houses to move up, and so on. Sometimes, the good news is that the market is strong and balanced, which is where we seem to be in the Red Deer market. The smaller surrounding markets are still in buyer’s market territory with ample supply, which is good news for home buyers willing to move to a smaller center.

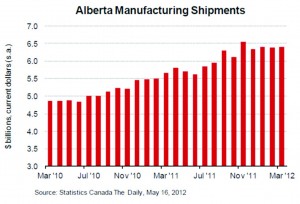

Manufacturing Flattens Out – Todd Hirsch Senior Economist, ATB Financial

Factory floors and refineries in Alberta have been a blur of activity lately. However, the rate of increase seems to have levelled off somewhat in the first quarter of 2012.

Manufacturers in Alberta shipped a total of $6.4 billion worth of goods in March. That is only a slight improvement over February (+0.5 per cent). Total Canadian manufacturing sales jumped by a more impressive 1.9 per cent in March to $49.7 billion. This is the largest advance since September 2011. The gain was led by the petroleum and coal products industry, which was led by output in Ontario’s refineries.

Alberta’s manufacturing sector is essentially an extension of the energy sector. The largest manufacturing category is petroleum and coal products ($1.6 billion), which includes all of the products pumped out of refineries.

Other important categories are chemicals ($1.1 billion), machinery ($740 million) and fabricated metal ($500 million). The two main categories that are not related to the energy sector are food products ($954 million) and wood and paper manufacturing ($329 million).

After having shown some steady gains throughout 2011, manufacturing in Alberta has levelled off. This could be related to the stagnation of oil prices at around $US 100 per barrel for the North American benchmark price (Alberta’s oil sells at a discount to this). Manufacturers are still busy—they’re just not gaining much ground. Given that the province’s economy is back into “boom” mode, some tempering of activity in manufacturing may actually be a bit of a welcomed sign. Things can overheat quickly.