June 15, 2012 Market Update

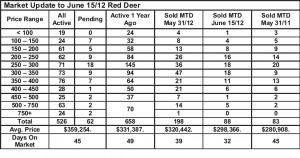

Market Update – The local real estate market pretty much reflects the provincial outlook provided by CMHC. The Red Deer market continues to be strong, although not as busy as earlier in the spring. As always, activity is strongest at the low to middle end of the price spectrum. We have seen activity slow most dramatically from spring in properties priced over $500,000 where the sales to listing ratio is less than 10%. That means that less than one out of ten homes for sale in that price range will sell in a month. The Blackfalds market is a reflection of the Red Deer market with strong sales and a high sales to listing ratio.

Sales in Lacombe, Sylvan Lake and Ponoka are also stronger than last year, but the ratio between listings and sales still favours buyers.

Long term predictions for the market would be dangerous. Obviously the central Alberta market is heavily dependent on a strong energy sector. A slower world economy demands less energy and less demand equates to lower prices. If world oil prices drop below $80/barrel, there is concern that our local energy sector will slow down. On a positive note, the US economy seems to be gaining traction and the US is our largest trading partner. Stronger demand there may offset a slower world economy.

Our best guess for the near term is a stable market, with adequate supply (or excess) supply in most markets. Under the circumstances, we don’t expect to see much price appreciation, but do expect very stable prices.

Excerpts from CMHC Housing Outlook – 2nd Quarter 2012

Rising employment, population gains, and low mortgage rates will help propel resale transactions in 2012 in the Prairies to 85,200 units, up almost seven per cent from 2011. MLS® sales in Alberta will rise by over seven per cent to 57,600 units in 2012, then increase to 59,200 units in 2013…..

The Prairie’s average MLS® price will increase by near three per cent in 2012 to about $327,000. A similar level of growth will raise the average price toward $337,000 in 2013. Over half of Alberta’s major markets remain in buyers’ market conditions, holding back price growth….

The average MLS® price in Alberta is projected to rise by about two per cent to $360,900 in 2012. With improved market balance in 2013, Alberta’s average resale price will rise by near three per cent to $371,500.

In Alberta, competition from the resale market and rising inventory levels caused builders to reduce single-detached starts in 2011. Improving economic and demographic conditions are now lifting housing demand and builders are responding by increasing production. In 2012, single-detached starts are projected to rise by 15 per cent to 17,500 units.