July 15, 2012 – Market Update

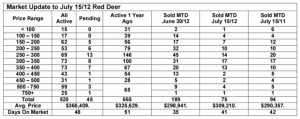

Month to date July sales in Sylvan Lake just about the same as the same period in July in 2011 and also the same as the first two weeks in June, while Red Deer sales have slowed compared to last month and last year.

It’s hard to understand why local markets can be so different, but it is possible that the smaller centres are finally catching up a little with Red Deer.

The world economic situation seems to have stabilized slightly in the past few weeks and the price of oil has held just above $80. That is good news for central Alberta and as long as those indicators remain stable, we expect our real estate markets to be stable as well. The Red Deer and Blackfalds markets still favour sellers and the Lacombe, Sylvan Lake and Ponoka markets favour buyers.

Excerpts from ATB Financial Weekly Economic Bulletin – July 13, 2012

Mixed housing market signals – Regulatory changes geared at cooling the housing market came into effect this week—but data on how much the market was already cooling in recent months, is providing mixed signals.

Last week sales data showed a precipitous drop in June, while this week construction data came in relatively strong, with strong housing starts and new home price data.

Year-over-year the new home price index rose 2.4 per cent in May. This was driven mostly by Toronto, where prices rose 5.5 per cent (in Alberta new home prices were flat).

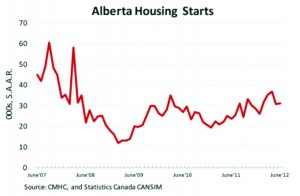

Housing starts data for June was also surprisingly strong coming in at a seasonally adjusted annual rate of 222,700 units—that’s about 5 thousand more than May’s number.

Total starts in Alberta were 31,100 in June, steady from starts in May. Starts in our province’s two major cities made significant jumps, with Calgary numbers 65 per cent higher than in 2011 and 46 per cent higher in Edmonton.

2011 Natural Gas – Anyone who follows the natural gas market would probably like to forget 2011. For that matter, the first half of 2012 as well. The folks at the Energy Information Administration (EIA) aren’t in the business of forgetting however, publishing a year-end review for natural gas in 2011 this week.

The EIA charts a disastrous year for 2011 in which average prices dropped to $3.98/MMbtu from 2010’s $4.37/MMbtu. This was due to record high production and storage levels, which pushed the price even lower through 2012. Why did production keep rising despite rock bottom prices? The EIA attributes this not only to the cheap abundance of shale gas, but the desire of drillers to drill for crude and other projects that produced natural gas as a by-product.