August 31, 2012 – Market Update

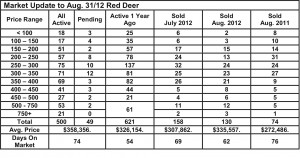

Red Deer sales in August were down almost 18% from July. Sales in the starter market (up to $300,000) were down 33% which is likely the result of tightened mortgage qualifying rules imposed earlier this year. The rental market is showing signs of strain with very low vacancy rates and rapidly increasing rents. That pressure is likely to translate into more started activity going into the fall.

On the other hand, sales at the higher end of the price spectrum ($400,000 +) have been much stronger this summer than last. Buyers for those homes are probably less impacted by the mortgage rule changes and are finding good value for their money.

Generally, the market is much slower this summer than it was in the spring with sales to listing ratios trending back to buyer advantage territory. More building starts this year have helped keep demand from overwhelming supply as in-migration into Alberta from other provinces continues to be strong.

Excerpts from Aug. 31/12 ATB Financial Weekly Economic Bulletin by Todd Hirsch & Will Van’t Veld

Canadian GDP chugs higher – One of the most reliable and closely watched indicators of economic activity is the quarterly national accounts, which measures the gross domestic product. On this final day of August, we learn that the Canadian economy keeps chugging along—slowly but surely.

The total value of all goods and services produced in the Canadian economy grew by 1.8 per cent in the second quarter of 2012 (adjusted for inflation), according to the latest release from Statistics Canada. That slightly exceeded the 1.6 per cent expansion predicted by a consensus of economists.

Speaking to the media this morning, Canada’s Finance Minister Jim Flaherty said: “We have now witnessed four straight quarters of economic growth. While the growth is modest, it reinforces Canada’s positive economic track relative to other countries. Indeed, Canada continues to have the strongest economic growth of all of the G7 industrialized countries.”

There is no quarterly breakdown available for the provinces, but Alberta’s energy sector may have been one of the contributors to the country’s overall growth. Statistics Canada reports that “oil and gas extraction increased 1.0% in the second quarter, as an increase in crude petroleum production was partly offset by a decrease in natural gas extraction.” The relatively good news for the economy lifted the Canadian dollar this morning, which was up almost half a cent against the U.S. dollar.

However, the growth will not be strong enough to convince the Bank of Canada to raise interest rates. With very little inflation pressure building, and only modest growth, there will be no appetite building at the Bank to hit the button on rate increases until well into 2013.

U.S. economic update – Economic growth in the United States came in slightly better than expected in the second quarter, at 1.7 per cent. This was down from 2 per cent in the first quarter. Most GDP components were slightly slower in the second quarter, which was expected, but net exports came in more positive and government spending decelerated less than it did in the first quarter.

U.S. housing continues to be a good news story, with the influential Case-Shiller Home Price Index increasing 1.2 per cent on a year-over-year basis in June, the first time the indicator has turned positive since the 2010 home-tax buyer credit. The Case-Shiller index measures the change in home prices that have been sold at least twice. In other news economic news, U.S. personal consumption expenditures and disposable income for July came in fairly strong, increasing 0.4 and 0.3 per cent, respectively. This was the fastest consumption

expenditures increased in five months. On a less optimistic note, new jobless claims benefits have remained relatively flat, indicating that employment has yet to pick up significantly enough to reduce the unemployment rate.