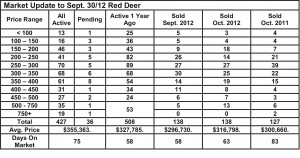

November 2, 2012 – Market Update

This is the time of year when the market goes into a slower “winter” mode. In spite of the sudden wintery weather, October sales were strong, keeping pace with September and up from last October. In the meantime, the number of active listings has fallen to its lowest level in years. Strong sales combined with a shrinking supply means the market is now in balance – where neither buyer or seller has an advantage. A balanced market is ideal, offering buyers an ample supply of homes to satisfy their needs, and sellers an opportunity to find a buyer willing to pay a fair price. A balanced market means prices should keep pace with inflation only.

We have been conditioned to believe that strong house price inflation is a good thing, but the only winners when that happens are the banks. Let’s face it, house prices in any market will rise and fall in unison. It’s a mistake to think that if my house goes up 10% in value, I can sell it and move up with the profit. Actually, the house I will buy has also gone up 10%, and I will have to finance the difference. Here’s a tip: Buy bank shares.

Comparing Canada with pre-housing meltdown U.S. shows all ‘we have to fear is fear itself’ Tara Perkins – Globe & Mail – Oct 31/12

Two well-known economists suggest the angst about Canadian consumer debt is overdone. And, one says in a new report, Canadians need not fear a U.S.style real estate meltdown.

The comments by deputy chief economist Benjamin Tal of Canadian Imperial Bank of Commerce and chief economist David Rosenberg of Gluskin Sheff + Associates come amid repeated warnings for the Bank of Canada that consumers must get a handle on their record debt burden as the country heads toward an inevitable increase in interest rates.

The central bank went so far last week as to warn that it could raise rates if they don’t, though that appears unlikely at this point. The key debt-to-income measure has been particularly worrisome, in that it has now surpassed the level at which the United States hurtled into the real estate crash.

But, Mr. Tal said Tuesday, less attention should be paid to the level, and more to the speed at which it has been rising. Several countries have had higher ratios with a meltdown, he suggested, adding that in the last three years that measure has climbed at half the speed than that of the precrash era in the United States, making it appear less threatening.

He also stressed that the quality of mortgages in Canada, as determined in large part by the credit scores of borrowers, is much better. One-third of U.S. mortgages taken out in the U.S. in 2005 and 2006 were in negative equity positions before house prices dropped, and at least half of the mortgages had less than 5 per cent equity, making them extremely vulnerable to even a small drop in prices. In Canada, only 15 to 20 per cent of new mortgages have less than 15 per cent equity, and the negative equity position is nil, he said.

In addition, Canadian borrowers have begun reducing their exposure to rising interest rates by choosing fixed-rate mortgages over variable. The opposite occurred in the U.S., where adjustable rate mortgages remained popular until the bitter end.

Mr. Rosenberg also talked down the issue, having heard “all of the horror stories” of late. Among his points: Disposable income in Canada is “distorted” against that in the U.S. because Canadians pay for health care from taxes, household debt relative to assets is below peak levels, Canadians have more equity in their houses, wage growth in Canada is double that of the U.S., and debt-servicing abilities are “hardly being impaired.”

Mr. Tal does believe house prices in Canada will probably fall over the next two years, but there are factors to lessen the blow, leading to a soft landing. That’s what policy makers are hoping for. Those factors include a lower degree of speculation in the Canadian market, and higher quality mortgages…..