January 31, 2013 – Market Update

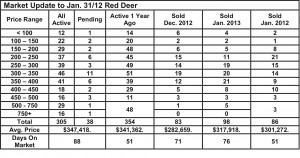

There was one buyer for every three homes for sale in Red Deer in January. That puts us firmly into Seller’s market territory. The reason is likely that buyers are entering the market before spring inventories have a chance to establish.

Sales are typically slow in January and February and pick up in the spring along with the number of active listings. This year, the Buyers are out early, probably because the rental market is experiencing low vacancy rates and rising rents and low interest rates are making home buying an attractive option.

As always, there are reasons to be concerned and there are reasons to be optimistic. It seems Albertans are choosing to be optimistic.

Behind the Bank’s Change of Tune by Will van ‘t Veld Economist, ATB Financial

Last week, the Bank of Canada stated it is no longer looking at raising interest rates any time soon. That’s because Canadian households now seem to be taking on debt at a slower pace and inflation remains tame.

But the central bank’s outlook shift is also due to a more negative view of Canadian economic growth. And that’s what makes it so noteworthy.

Since the fourth quarter of 2008, Canada has averaged an annualized quarterly growth rate of about 2 per cent. Not stellar, but better than most industrialized nations. Household and government spending has led the way, contributing an average of 1.2 and 0.4 per cent, respectively. But these sectors are running out of steam. With debt loads rising, governments and households will be looking closer at their spending.

If you could flip a switch, this would be the perfect time to shift from domestic consumption spending to business investment and export-driven growth. But there is no switch. Investment spending has been a huge boost to Western Canada, where real business investment is up 44 per cent since 2009, but elsewhere in the country business hasn’t been so eager.

Excluding B.C., Alberta and Saskatchewan, business investment in Canada has rebounded 20 per cent, putting real business investment at near 2008 levels.

As for Canada’s trade situation, it’s not great. Between manufacturers getting hammered and oil producers getting a reduced price, Canada’s net trade position has been a significant drag on growth.

There is hope the economy is in a transition. A rebounding U.S. economy will likely be good news for exports and investment growth and pipeline developments will likely reduce the price differential. If this doesn’t play out, the Bank of Canada might stay on the sidelines for even longer than any time soon.