February 15, 2013 – Market Update

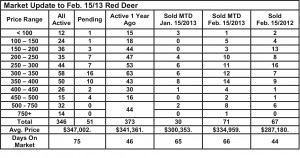

The real estate market in central Alberta in February is strong. Red Deer, Blackfalds, Sylvan Lake and Lacombe sales are up noticeably from the same period in January while Ponoka is keeping pace. The number of listings is also up slightly, but the gap between supply and demand has narrowed.

If we assume that the market is going to continue at its current pace, it would be easy to predict a listing shortage, stronger sales and inflating prices for the rest of the year. That forecast may be premature until we see what the provincial budget has in store and whether the US approves the Keystone pipeline.

The differential between world oil prices and what we sell our oil for in Alberta has created a shortfall of $6 billion in government revenue and the way the government reacts to that in the budget on March 8th could have an impact on the housing market. Approval for the Keystone pipeline would generate optimism and the pace that the oil sands develop. That approval would be huge for Alberta in every way.

According to the article below, it appears that the construction industry is very cautious going forward, which is a good thing.

Housing’s delicate balance – Todd Hirsch Senior Economist, ATB Financial

Last Friday, Canada Mortgage and Housing Corp. released new data on housing construction across the country. In Alberta, the monthly number was a bit disappointing. However, a longer-term vantage point can offer a more encouraging perspective.

In January, home builders started construction on 29,366 houses across all areas of Alberta (seasonally adjusted and at an annualized rate). That’s the second month in a row in which housing starts had fallen, and one of the lowest totals over the last 18 months. There’s no question the pace of home construction has moderated. Indeed, starts could slow a bit more in the coming months given the economic headwinds the province is starting to experience.

Still, the January housing starts remain above the five-year average. And given the steady and moderate increase in the price of new homes, the market appears to be in relatively good balance.

During the boom years of 2006 and 2007, when housing starts were above 40,000 annually, there was actually a surplus of homes being built. That led to a glut of properties during the 2009-10 recession, and housing starts plummeted (see graph).

This time around, however, home builders appear to be more constrained; fewer homes are being built on the speculation of buyers (“spec” homes). That should leave the new home market in reasonably good shape if the economy continues to slow in 2013. Fewer excess homes on the market will help support prices and maintain balance.