February 28, 2013 – Market Update

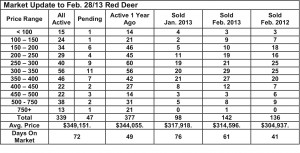

The Red Deer market seems to be firing on all cylinders and heavily favoured sellers in February. The sales to listing ratio was 44%, well above the 30% that indicates a seller’s market. And, it is becoming difficult to find good homes for sale, especially in the $200,000 to $450,000 price ranges. Properties priced higher than $450,000 are still not experiencing the same activity and may represent a market where a buyer can still find good value.

Sylvan Lake sales are pretty much keeping pace with last year while the number of active listings is down from last winter especially in the $200,000 – $350,000 price range. Sales in Lacombe are keeping pace with last year but the number of listings is down. Ponoka sales are down from last year and listing inventories are higher, which may cause some Lacombe buyers to consider Ponoka as an option.

It’s hard to define why all central Alberta markets are not on an even pace except that historically it seems that the smaller markets follow behind the larger Red Deer market. As inventories shrink and prices start to firm in Red Deer, the surrounding markets will become a more attractive option.

At first glance, the article below is a little frightening, but if you read to the end, you will notice that Alberta seems to be the one place escaping the reality of the rest of the world’s economic doldrums. That quite likely makes Alberta an attractive destination, which creates more demand for housing, which creates jobs and economic activity and so on, and so on.

Canada’s economy tumbles in December – Todd Hirsch, Senior Economist, ATB Financial

Economic growth in Canada was already on an established downward trend in 2012, but by the final month of the year the overall GDP slipped into contraction.

In December, the value of total goods and services produced in Canada fell by 0.2 per cent compared to November. That followed a surprisingly strong month of growth in November (+0.3 per cent), and was only the third month in the year in which the economy slid into reverse. On a quarterly basis, the fourth quarter of 2012 saw a small expansion of 0.2 per cent, matching the gain in the third quarter.

For the entire year, Canada’s real GDP expanded by 1.8 per cent in 2012 after growing by 2.6 per cent in 2011.

The monthly dip in economic activity was due to particular softness in a couple of key industries. According to Statistics Canada’s media release this morning: “Manufacturing and, to a lesser extent, retail trade and utilities were the main sources of the December decline. Wholesale trade, transportation and warehousing, as well as the arts and entertainment sector also decreased.”

There were a few bright spots in December, however, including mining, oil and gas extraction. Nationally, it advanced 0.3 per cent over the previous month. This morning’s data do not provide breakdowns provincially, but given that Alberta accounts for about 70 per cent of Canada’s oil and gas industry, the numbers suggest Alberta’s economy was still expanding at a healthier rate than was the rest of the country.