May 31, 2013 – Market Update

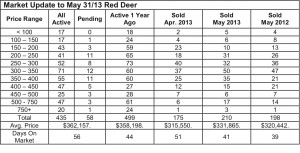

Another strong sales month in Red Deer – up 20% from last month and slightly ahead of May 2012. The number of active listings did rise in May which is keeping the relationship between supply and demand from getting severely out of balance. The rest of the central Alberta market continued on an active pace in May with sales up again over last month, but that market also saw an increase in the number of active listings and the Sylvan Lake, Lacombe and Ponoka markets are still balanced slightly in favour of buyers. We are seeing more buyers expanding their searches into the outlying markets looking for more choice and better prices.

The ATB article below explains why our markets are good, but not going out of control. The Canadian economy is moving a little slow, but oil prices are still quite strong which keeps Alberta at the head of the Canadian economic pack. The pace of growth in Alberta is so far being matched by the construction industry adding living accommodations in pace with demand.

Canada’s economic thaw – Todd Hirsch, Chief Economist, ATB Financial

With spring slowly morphing into summer in Canada, it appears the temperature is not the only thing on the rise. Canada’s economy is slowly crawling out of last year’s winter chill.

In March, the Canadian economy expanded by 0.2 per cent over the previous month. While that is shy of the rate of growth in January and February, it is the third consecutive month in which the gross domestic product has advanced.

For the entire first quarter of 2013, Canada’s economy expanded by 0.6 per cent quarter-over-quarter, the fastest pace in over two years. The major contributor to growth was the mining and oil and gas sector, which advanced 4.1 per cent in the quarter. This was due largely to higher prices for Canadian crude oil, which pushed up the value of exports.

At an annualized rate—that is, the rate of growth the economy would experience if this same pace was sustained for 12 months—Canada’s economy grew by 2.5 per cent in the first quarter. That is ahead of the comparable growth rate in the U.S., which clocked in at a revised 2.4 per cent.

The GDP’s growth in March and in the first quarter is a good sign for the Canadian economy. Nonetheless, the pace of growth is still somewhat below what the Bank of Canada would regard as “potential growth”— meaning some excess capacity remains in the economy. Today’s GDP report is unlikely to change the Bank of Canada’s position it took earlier this week when interest rates were kept unchanged.