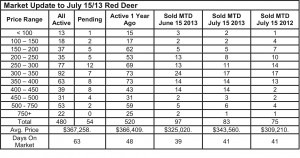

July 15, 2013 – Market Update

Red Deer sales in the first half of July are off slightly from the same period in June, but up from the same period in July 2012. The number of active listings has jumped in the past two weeks bringing the sales to listing ratio closer to a balanced market but still in seller’s market territory. The large increase in the number of listings was mainly in the $250,000 – $350,000 price range which coincidentally is where the most activity is. That bodes well for those home buyers.

Like other central Alberta municipalities, there is substantial speculative new home construction in Red Deer with a good range of pricing. The activity in new construction is helping to keep supply and demand in balance as it adds new inventory to the housing market at a time when substantial numbers of people are moving to central Alberta. It appears there is adequate development land available to provide lots for the growth we are experiencing.

As long as the builders can keep pace with demand, the market is likely to stay balanced and prices will remain at current levels. The economic forecast for central Alberta is good as a result of strong activity in the energy sector, the billion dollar expansion at Joffre and will also be helped by a great farm crop year, but not so strong that we should expect price inflation like we experienced in 2006 and 2007.

Home builders busy – Todd Hirsch, Chief Economist, ATB Financial

The inflow of inter-provincial migration into Alberta is having a positive effect on much of the economy. One of the most noticeable has been on the increased demand for new housing—and builders are busy keeping up.

In June, developers got started on 38,709 new homes in our province. This figure is annualized, which suggests the total number of houses that would be built in a year if this pace of building keeps up for 12 months. It is also adjusted to account for seasonal variation in home building.

The June figure is a bit of a dip from May, but it is still about 14.6 per cent higher than June of last year. It’s also about 40.9 per cent higher than the five-year average annualized rate of 27,400 new homes.

Housing starts are an extremely important economic indicator. Not only does it point to the growing level of consumer confidence in the province, it also bodes well for construction jobs in the coming months.

There is also a good deal of peripheral retail activity around a new home such as new appliances, flooring and furniture. One worry is that too much building could result in an oversupply of unsold homes on the market, especially if developers are building a good number of homes on speculation (or “spec” houses). That was a problem in 2008 when residential prices dropped. However, demand for homes in 2013 appears to be keeping pace with the new supply—at least for now.