January 15, 2014 – Market Updates

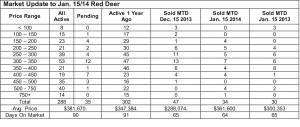

January sales are off to a good start, down from the same period in December but better than the first two weeks in January 2013. The number of pending sales suggests that January will end with fewer sales than last year. Weather and lower inventory levels are two possible reasons for a slower month. In the meantime, the number of active listings is below 300, less than needed to maintain market balance, but not unusual considering the time of year. Listing counts typically start to rise in February and March in anticipation of the spring market.

There are lots of reasons to be optimistic for the economy and the real estate market in 2014. Oil and gas prices are still high enough to keep our energy industry busy, especially since our dollar has dropped compared to the US dollar. We sell our oil for US dollars, so both the government and the energy industry benefit from a lower Canadian dollar. Canadian exporters also benefit. The losers are those still considering real estate purchases south of the border. Not only will those purchases cost more because of the lower dollar, prices are up in the sunny markets. That may result in less cash moving south and more being invested here. Another positive.

Building Permits Remain Strong – Todd Hirsch, Chief Economist, ATB Financial

Construction activity is one of the pillars of Alberta’s economy. It provides amply employment and boosts gross domestic product. Judging by new data on building permits, that activity—and the spending that comes along will it—will continue through 2014.

Building permits issued by municipalities and counties are an excellent indicator of future activity (a “leading indicator” in the language of economists) because they must be secured by the builder prior to any construction starting. They represent what builders plan to spend in the coming months. According to Statistics Canada, $1.47 billion in building permits were issued in Alberta in November (seasonally adjusted). That’s down from the $1.5 billion issued in October, but permits are 17.0 per cent higher over the most recent 12 months compared to the previous.

Residential building permits dipped to $875 million in November—the second consecutive monthly decline—but they are still well above levels over the last several quarters. This was partially offset by an increase in non-residential permits to $590 million.

Alberta to Open India Trade Office – Todd Hirsch, Chief Economist, ATB Financial

Alberta is expanding its international horizons with the opening of a trade office in India. Premier Alison Redford will open the New Delhi office during a trade mission this week. While not the same economic powerhouse as China, India is the world’s second largest country by population and a potentially huge market for Canadian exporters.

Over the last ten years, Alberta’s exports to India have averaged close to $100 million annually. Data are available only for the months of January to October of last year, but based on these ten months (down 12.2 per cent from 2012) total trade for the entire year should be close to $103 billion. Relative to the $83 billion (with a B) that the province exported to the United States in 2012—and the $96 billion to the entire global market—trade with India is tiny. It represents about a tenth of one per cent of Alberta’s total exports.

However, with a population of 1.27 billion (also with a B), India is a potentially huge market for Alberta. Traditionally the largest exports to India have been agricultural products—notably dried peas, which account for nearly half of Alberta’s total exports to that country. Other significant exports include polymers of ethylene and, surprisingly, radio navigational aid apparatus.

The one thing not on the list of exports to India is crude oil but that may change in the coming years. Potential pipeline projects to move Alberta bitumen to tide water at either Kitimat, British Columbia, or Saint John, New Brunswick, would open up that possibility.