December 19, 2014 – Market Update

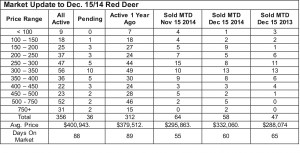

Sales in the first two weeks of December were almost as good as the same time in November while the number of active listings dropped again, but stayed above last year’s level. Activity is strong at the high end of the price spectrum which is a little unusual at this time of year. The number of pending sales suggests we could end the year with above average sales for December. It’s too early to tell what impact falling oil prices will have on the market, but unless they drop dramatically and stay down for an extended time, the impact could be slight. Many experts are predicting oil prices to recover in less a year or less. That would likely mean a chance for the local housing market to stabilize and catch its breath. Sometimes a little breather is not a bad thing.

Oil production not faltered by price – Nick Ford, Economist, ATB Financial – Alberta’s crude oil producers don’t seem too troubled by the plethora of news stories and business columns detailing oil’s price plunge, at least according to new Statistics Canada data on oil supply and distribution. Instead of cutting in September, Alberta’s oil producers extracted the same amount as in August and exported even more. Since 2013, oil extraction has grown by eight per cent year-over-year. On a more impressive note, total oil withdrawn in Alberta has increased by 46 per cent over the past four years.

Exports were approximately 1.2 million barrels higher in September, marking a two per cent increase over August. Crude exports are 16 per cent higher this year than last. Virtually all of Alberta’s crude oil exports are sent to the United States, which is particularly interesting given the success of fracking south of our border.

We may still see similar output and distribution over the next couple of months. One reason is the simple fact that many oil producers need the money. Even with less than optimal prices, producers that have hedged large sums of money require funds to pay investors and creditors. Cutting off or easing operations could terminate valuable operating revenue and prove even more costly.

Jobs report shakes off falling energy prices – Todd Hirsch, Chief Economist, ATB Financial – If plummeting oil prices are expected to bring waves of layoffs in Alberta, it appears that companies in the province haven’t bought into the panic—at least not yet. In fact, last month the number of jobs in our province actually increased. According to this morning’s Labour Force Survey, total employment increased by 3,200 (adjusted for seasonality), all of them full-time positions. Alberta’s unemployment rate remained unchanged at 4.5 per cent.

There were significant gains in construction (+9,100), health care and social assistance (+6,500), and even in oil and gas (+4,700)—the sector around which there is some worry at the moment. While the price drop for West Texas Intermediate probably overstates the price drop for Western Canadian oil, there is no question that producers in this province are seeing lower cash flow.

But while the number of jobs increased, there may still be some cracks starting to show in the energy sector. Employment in professional, scientific and technical services took a big hit—a loss of 11,000 jobs. Occupations in this category include geologists, engineers, accountants, lawyers and technicians—the kinds of services acquired by oil and gas producers. Even though they didn’t lay off any of their own workers, energy producers may be starting to pull back on contracts with external service providers.

Also, the survey of employment was conducted between November 9 and 15—and since then the price of Western Canadian Select blend oil has slumped another $10 per barrel. It’s almost certain that at least some job losses in the province are still to come.