MARKET UPDATE – December 15, 2016

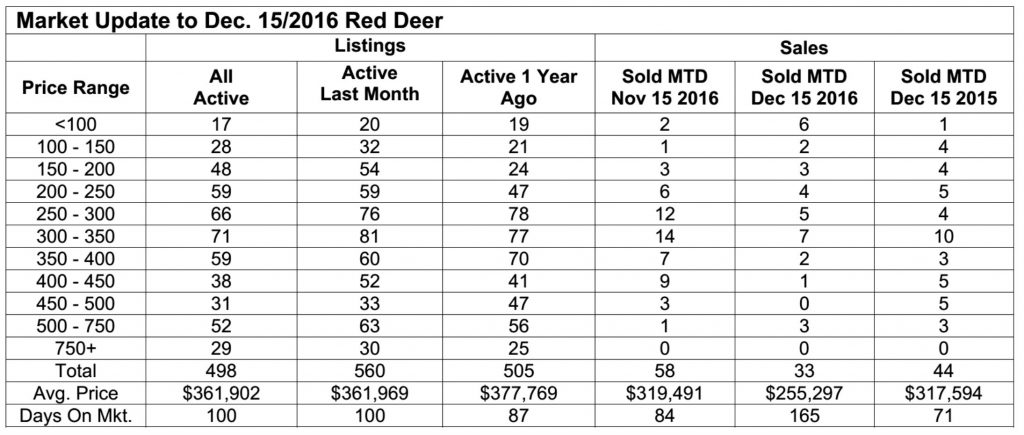

Monday, December 19th, 2016Sales in Red Deer in the first two weeks of December dropped by almost 50% compared to the first twoweeks in November. The number of active listings also dropped, back to levels we saw last year at this time and well below the peak reached in the spring of this year.

Last year at this time oil prices were headed into the $US28 range and optimism was not very high. The outlook is much better this year, but we are now being impacted by the federal government’s tougher rules for mortgage qualifying that have reduced the average buyer’s ability to finance their home purchase. It is an effort to curb rising prices in Toronto and Vancouver, but unfortunately, their country wide tinkering is negatively affecting Albertans who can least afford it.

Other than the new Alberta Carbon Tax, there has been lots of good news lately in addition to strengthening oil prices. Two pipeline approvals, increased 2017 budgets on the part of several major oil companies, oil patch workers being called back and one of the most visible signs of all – oil company truck convoys on the highways. Natural gas prices are also up, as indicated in the ATB article below.

Natural Gas Prices Jump Up …… Quietly by ATB Financial Economics

In case you missed it, natural gas prices have climbed to levels not seen for about two and a half years. As of yesterday, the Canadian benchmark’s (AECO) spot price closed around C$3.40/MMBtu while the North American benchmark, Henry Hub settled around $3.50/MMBtu.

The reason? Supply and demand.

First, let’s start with supply. Natural gas is required by oil producers for upgrading purposes and to run oilsands operations. As these businesses start to piece things back together and pick up the pace, they have been forced to draw a bit more natural gas from inventories thereby reducing supply. But, it’s not just businesses drawing down stockpiles, it’s us, the consumers too!

With temperatures dipping around -30*C, this cold snap that has covered much of the province has caused many Albertans to crank the temperature on their thermostats. Doing so has increased the amount of natural gas required to heat our homes and run Alberta’s businesses which has also caused a drawdown on storage supplies.

Collectively, these draws on natural gas inventories have boosted demand and caused the price to rise. Of course, as supply diminishes, demand bumps up and causes the price of natural gas to increase.

Both Canadian and North American gas prices are likely to stay at higher levels, at least as long as these cooler temperatures continue to stick around. AECO’s price is expected to float around C$3.40/MMBtu for the next couple of months while Henry Hub is expected to bounce around $3.50/MMBtu.